Annual Learner Driver Insurance

Annual learner & provisional driver insurance

Personalised pricing based on your driver rating

Easy-to-use app, with all your documents to hand

Quick access to our award-winning claims team

Get on the road in minutes with a personalised learner car insurance quote

We’re proudly featured in

Join the Zego community

81m

575k

96%

How does provisional insurance work?

Compared to being added as a named driver on someone else’s policy, learner insurance can often work out cheaper. It also protects the car owner’s No Claims Discount, which could otherwise be affected if an accident happens while you’re learning. If you insure your own car as a learner, you can even start building your own No Claims Discount helping you save on future premiums once you’ve passed your test.

What does our car insurance for learner drivers include?

Our cover includes:

- Everyday driving and commuting to a single place of work or study (SD&P)

- Personal accident cover up to £5,000

- Key and lock cover up to £500

- The loss, damage or theft of your vehicle and its spare parts

- Personal belongings cover up to £300

- Audio, communication and navigation equipment cover up to £500

- Costs for causing damage to other vehicles or property up to £5m

- Windscreen cover (£25 excess for repairs or £150 for replacement)

- Courtesy vehicle while yours is being repaired (with an approved repairer)

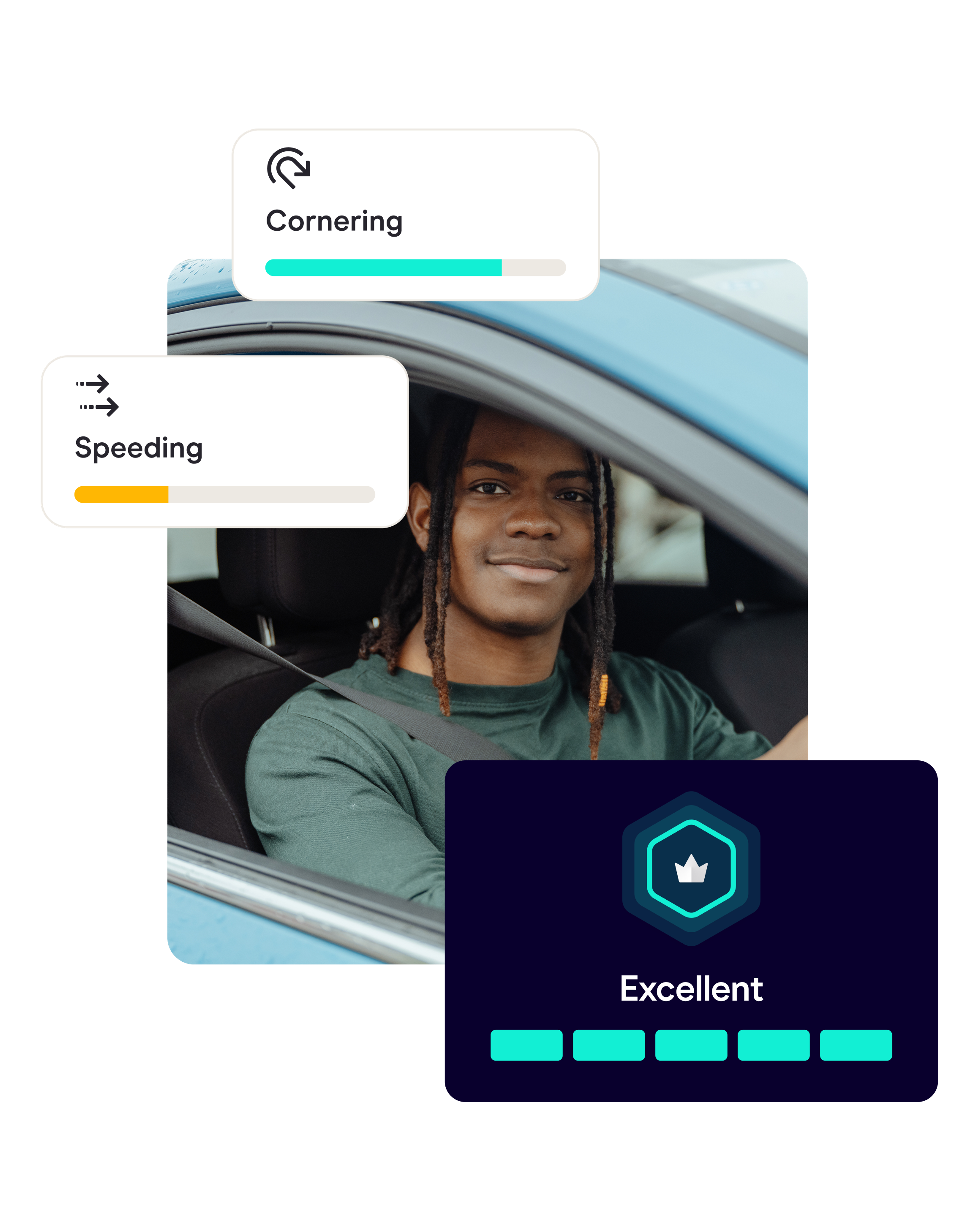

Learner insurance that moves with you. It starts with Sense.

100% app-based telematics policy – no black box needed

Premiums based on how you drive, not just your age or job title

Get real-time driving insights sent straight to your smartphone

Manage your policy anytime in the Sense app

Who can supervise a learner driver?

It doesn’t have to be the car owner who supervises you, but whoever does must meet a few key requirements:

They must be at least 21 years old

They must be qualified to drive the same type of car you’re learning in (for example, they need a manual licence if you’re driving a manual)

They must have held a full UK or EU driving licence for at least three years

No black box required – just your smartphone

There’s no black box to fit and no need to visit a garage. Sense runs through your smartphone, using its sensors to understand your driving behaviour.

You’ll also get insights and tips to help you build safer habits, helping you become a better driver.

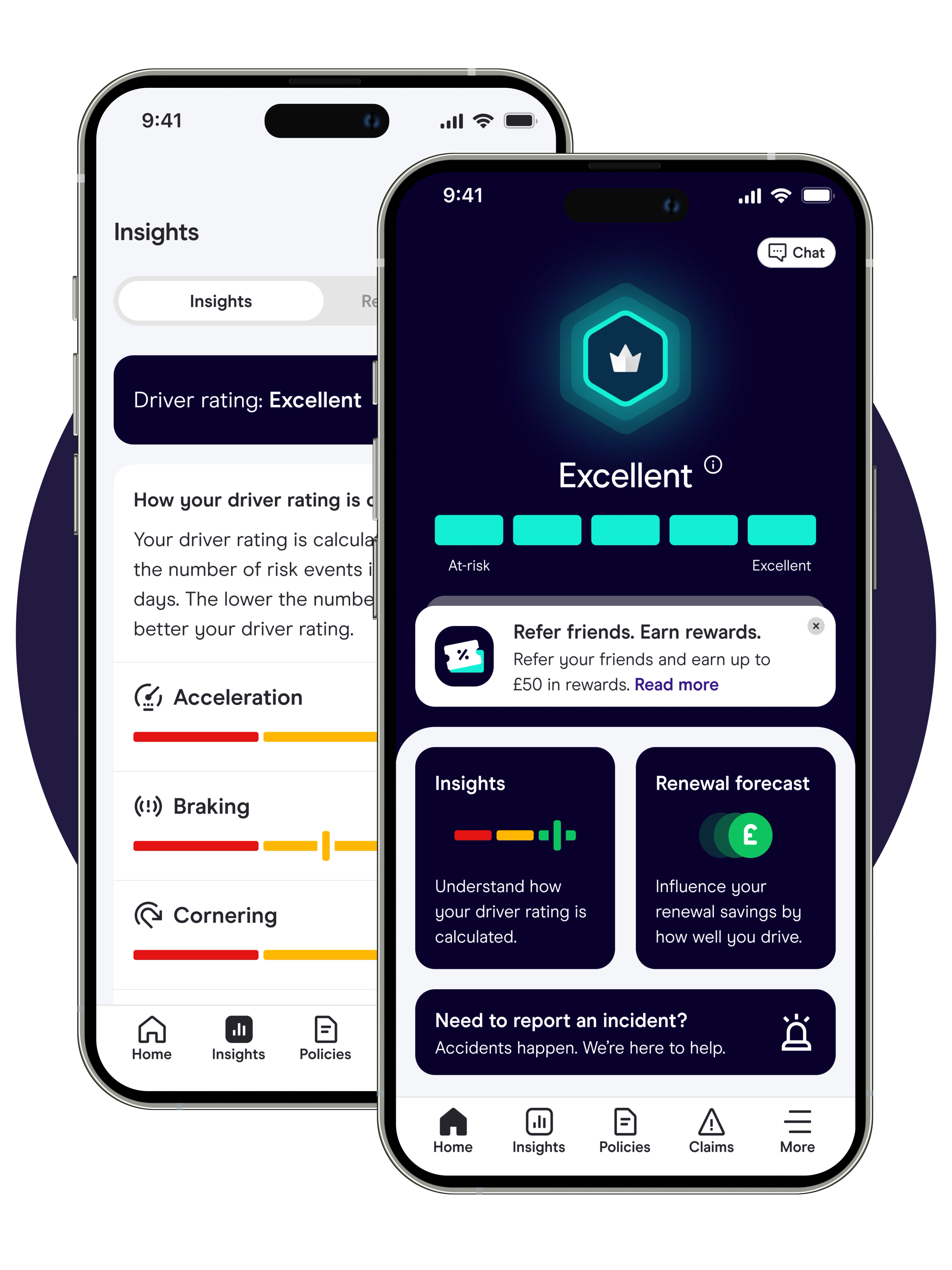

How telematics works

With Sense, there is no physical black box required.Your driving data is collected through your smartphone

The app monitors your driving over time using sensors

Your driver rating reflects your habits

Higher driver ratings earn you a personalised renewal quote

Easy and quick to download

Am I eligible?

Check if we can cover you before you begin.You’re 25–60 years old

You live in the UK

You have no previous claims or motoring convictions

You hold a full or provisional UK driver’s licence

Your car is valued at less than £30,000

What are the benefits of learner driver insurance?

Build confidence faster

Get used to your own car’s controls, mirrors, and handling. Familiarity helps you feel calmer behind the wheel and more in control, making your lessons (and test day) a lot less stressful.Save money while you learn

Practise as often as you like without paying for extra instructor time. With flexible learner driver insurance, you can top up your hours at your own pace and budget.Practise real-world routes

Drive on the roads you’ll actually use, from your commute to your local test centre. Learning in your own car helps you get comfortable with real-life routes and everyday driving situations.Fast-track your No Claims Discount

Start building your No Claims Discount before you’ve even passed your test. With learner driver insurance, every claim-free day counts, helping you save money when you switch to a full licence policy later on.Protect your car and your confidence

A dedicated learner insurance or provisional insurance policy keeps both you and the car owner’s insurance safe. Unlike being added as a named driver, your learner driver insurance policy runs independently, so any accidents won’t affect the car owner’s No Claims Bonus.Learn in your own car

With learner driver insurance, you can learn to drive in your own car rather than just your instructor’s. This helps you build familiarity with your own controls, mirrors, and handling, making you more confident and comfortable when it’s time to pass your test. Plus, having your own insurance policy for learner drivers means you’re covered for private practice alongside professional lessons.

Car Insurance that moves with you. It starts with Sense.

Download the Sense app

To get started, download the Sense app to your smartphone and activate your policy. It only takes a minute.

Start driving

Once you're set up, Sense starts tracking your driving to build a picture of how you drive each day – and gives you a driver rating.

Unlock our best price at renewal

The higher your driver rating, the better your chances of being rewarded at renewal.

Learn about Sense

Telematics Car Insurance For Learner Drivers with Zego Sense

Is This The Secret to Cheaper Car Insurance? Zego Sense

Learner Driver Car Insurance With Zego Sense

Trusted by 100,000’s of UK drivers

Frequently asked questions

“81 million...” – Based on the total number of policies sold by Zego as of 23/07/25

“575K drivers...” – Based on the number of fixed policies sold by Zego as of 23/07/25

“96%..” – Based on Zego customers who have been insured on Sense policies and have a driver rating, between 01/06/2025 and 01/08/2025