PERSONAL VAN INSURANCE

Drive safely, and get the cover you deserve

App-based telematics van insurance for personal use

Drive well and get a personalised quote at renewal

Manage everything in the app

What is van insurance for personal use?

This type of van insurance protects you for most types of personal journeys, including weekends away, hobbies and shopping trips. It does not cover you for work or business use, or commuting to and from work (for that, you’ll need a commercial van insurance policy).

Zego's app-based telematics insurance

Sense is currently available with our van insurance for business and personal use.

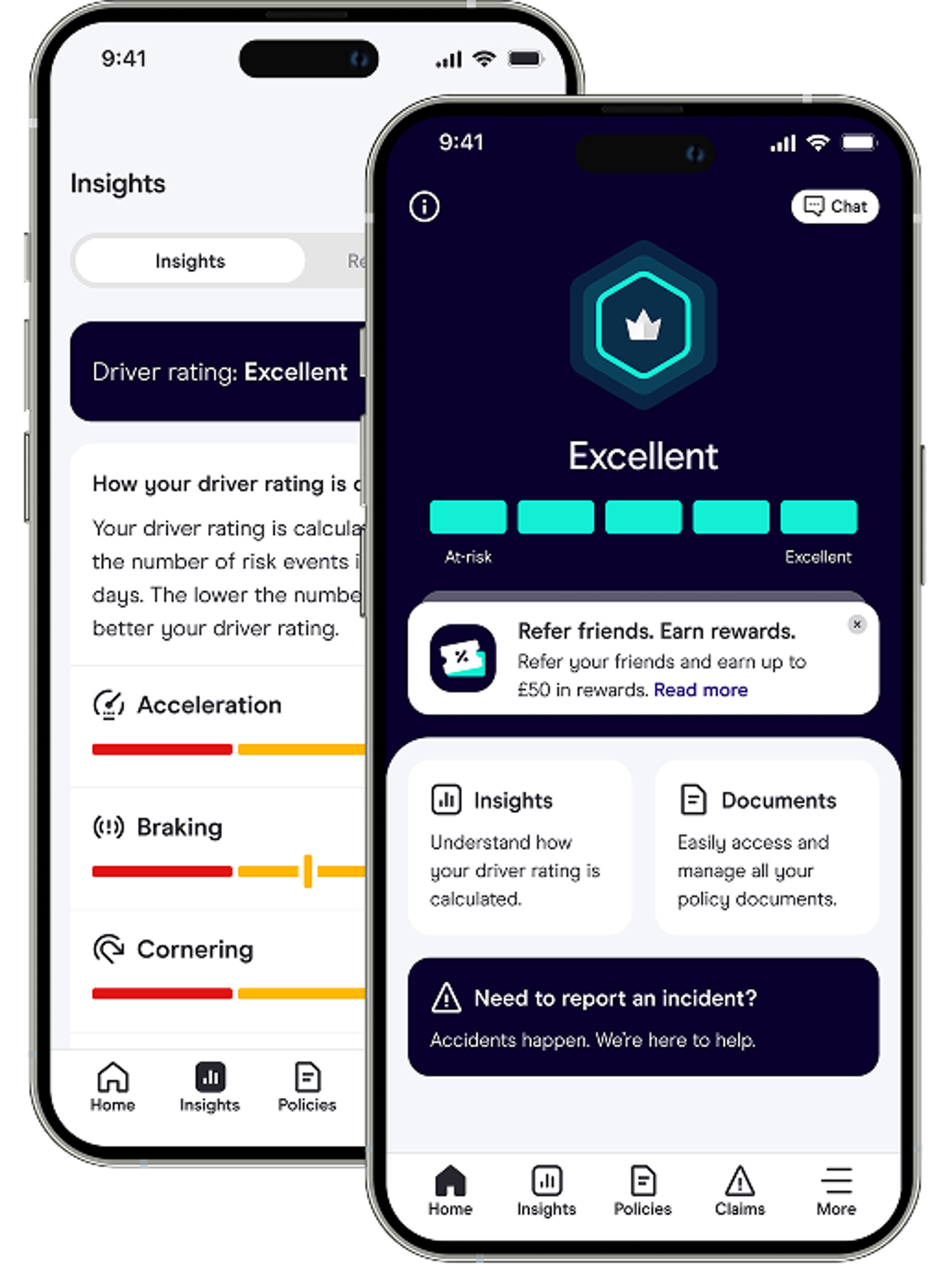

How Zego’s telematics works

With Sense, there is no physical black box required.Your driving data is collected through your smartphone

The app monitors your driving over time using sensors

Your driver rating reflects your habits

Higher driver ratings earn you a personalised renewal quote

Easy and quick to download

Why choose Zego Sense?

Sense gives you a bespoke renewal premium based on how well you drive.Price based on your personal driving habits

Monitor your driving in real time via the app

Tailored policies designed just for you

Access flexible policies at the touch of your phone

No need to install a black box!

How to get started

Signing up couldn’t be easier, simply secure your quote and download the app!Get a quote online and choose the type of cover you want

Pick a Sense policy

Download the app and switch on permissions

The app measures how well you drive over time

This will influence your renewal

Is personal van telematics insurance right for me?

Young drivers often face higher premiums due to inexperience. Telematics tracks driving habits and rewards safe driving no matter what your age.

Telematics policies can also offer lower premiums for low-mileage drivers who don’t drive much, as insurance costs are partially based on mileage and usage.

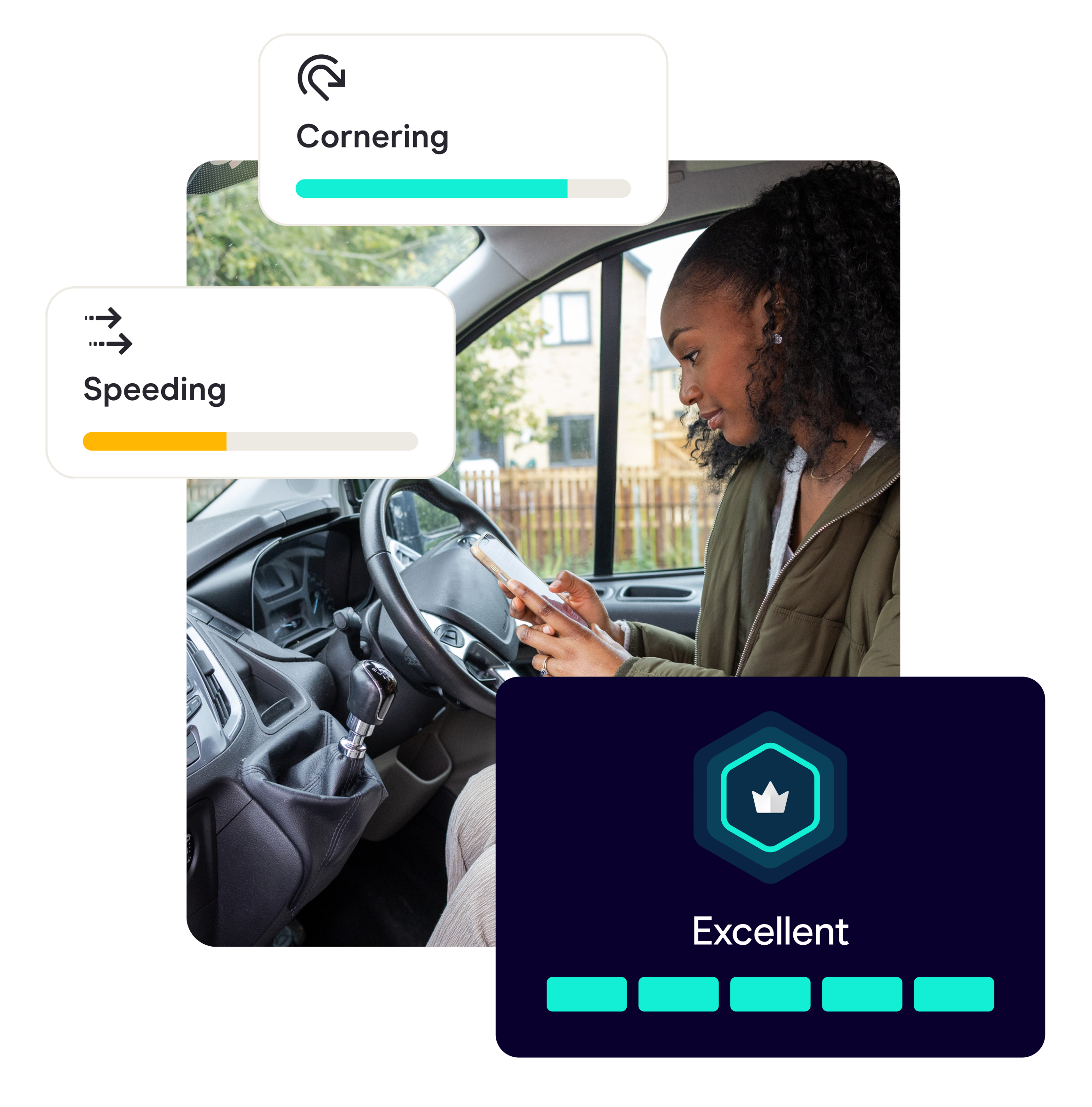

Safe van drivers can benefit from premiums that take into account good driving habits like smooth braking and cornering.

How does a telematics device or black box work?

With app-based telematics, your smartphone’s sensors track key driving factors like speed, braking, acceleration, cornering and rest. Alternatively, a physical black box installs directly into your car, providing data for accurate pricing.

Choose an app-based telematics policy today with Sense to enjoy personalised insurance rates, real-time feedback, and the peace of mind that comes with knowing you're paying only for the coverage you need.

Your driver rating

Measures how well you’re driving

Your driver rating is a reflection of how safely you drive. Based on factors like speeding, braking, cornering, acceleration and rest, this driver rating helps determine your premium.Driving habits

Adopt safe skills

Harsh braking, rapid acceleration, and speeding can lead to a bad driving rating. Poor driving habits not only increase your risk on the road, but can also raise your insurance premiums.Cornering, speed & braking

Maintain control

Fast cornering, excessive speeding, and harsh braking can all negatively affect your driver rating. Smooth driving leads to better safety.Reviewing your journeys

Assess your performance

With Sense, you can review each journey and get insights into your driving habits. Check your driver rating regularly to spot areas for improvement.

What level of van insurance for personal use can I get?

Fully Comprehensive

Policies tend to start at Third Party Only, which only covers other people and their property, but not you. Our van insurance is fully comprehensive. It’s the top level of protection, for that extra peace of mind.

What’s included with my van insurance for personal use?

- Cover for everyday, personal driving (social, domestic and pleasure)

- Loss, damage or theft of your vehicle and its spare parts

- Key and lock cover up to £300

- Costs for causing damage to other vehicles or property up to £5m

- Windscreen (£25 excess for repairs or £100 for replacement)

- Personal accident cover up to £5,000 and motor legal protection up to £100,000

- Personal belongings cover up to £300

- Audio, communication and navigation equipment cover up to £500

- Courtesy vehicle (with approved repairers)

What do I need to get a van insurance for personal use quote?

- Vehicle details: We'll need the make, model and registration number of your van, along with any modifications you've made.

- Intended use: Tell us how you’ll use your van, whether it's for occasional social trips and weekends away, or commuting to a regular place of work or study.

- Driving history: Tell us about any previous driving convictions, or van insurance claims you've made in the past.

- Driver information: Include details of any driver who will be using the van for everyday, personal driving.

- No claims bonus: If you have one, give us the details of any no claims bonus you've earned on previous policies. It could help to lower the cost of your cover.

- Extra security features: We may also need to know about any extra technology or security features installed in your van, such as immobilisers, alarms or trackers.

Increase your personal van cover with these extras

Simply add to your policy when you buy online.

No claims discount protection

Protect your no claims discount for extra money off at renewal, with up to one at-fault claim allowed.+6%

on the price of your policy

Breakdown cover

Combined roadside and recovery within the UK.£59.99

for annual cover

Why we're the right choice

81m

575k

96%

TELEMATICS VAN INSURANCE

Insurance that moves with you. It starts with Sense.

100% app-based telematics policy – no black box needed

Get 24/7 support from our award-winning claims team

Get real-time driving insights sent straight to your smartphone

Manage your policy anytime in the Sense app

Trusted by 100,000’s of UK drivers

What our customers say

This app has excellent service and is also very helpful. The price is a reasonable amount too! Overall, I really like this app.

It was a great experience, very smooth and easy. It was a pleasure to be assisted by professionals. I highly recommend Zego.

Great to know how driving carefully rewards you with lower premiums. This is the way forward!

Personal Van Insurance Frequently asked questions

Share and earn. It's that simple.

That’s £50 if they take out an annual policy, or £10 for a 30-day one. The more friends you refer, the more you earn.

*Excludes flexible, pay-as-you go customers.

“81 million...” – Based on the total number of policies sold by Zego as of 23/07/25

“575K drivers...” – Based on the number of fixed policies sold by Zego as of 23/07/25

“96%..” – Based on Zego customers who have been insured on Sense policies and have a driver rating, between 01/06/2025 and 01/08/2025