Car insurance excess is the amount you agree to pay toward any claim before your insurer contributes. It’s usually split into two parts: compulsory excess, set by the insurer, and voluntary excess, which you choose yourself to help adjust your premium.

When you make a claim, for example, your insurer won’t cover the full bill. Instead, they deduct your total excess from the payout and only pay the remainder.

Types of excess explained:

Type | Who sets it? | Typical range (2025) | Applies when |

|---|---|---|---|

Compulsory | Insurer | £50 to £3,000 | Set per policy or claim type |

Voluntary | You | £100 to £500+ | Optional, reduces premium |

Both types are usually combined. If your compulsory excess is £250 and you’ve opted for a £300 voluntary excess, you’ll need to pay £550 out of pocket for any approved claim.

And if the total cost of damage is less than that? You cover the full cost.

Why this matters

According to an article published in The Independent, citing Go Compare, there was an increase in the number of people choosing a £500 voluntary excess, from 20% in August 2022 to 23% in August 2023.

Meanwhile, it also stated that Confused.com said the average voluntary excess chosen by its customers had hit a record high.

That means a typical total excess could easily exceed £600 – which is a significant cost for new drivers or families trying to save money on premiums.

How does excess work in real life?

When you make a claim, your insurer subtracts your total excess from the payout, so you’re always paying part of the cost yourself. Whether that’s £150 or £1,000 depends on the excess levels in your policy.

Here is an example of how it could affect you:

Claiming with a £500 excess

Ayesha is 19, just passed her test, and took out a comprehensive car insurance policy for her first car, a used Ford Fiesta. To keep costs down, she agreed to a £250 compulsory excess and added a £250 voluntary excess to shave £180 off her annual premium.

One rainy afternoon, she bumps into a parked van. It was her fault. The repair bill? £1,400.

Here’s how it breaks down:

Item | Amount |

|---|---|

Total damage cost | £1,400 |

Ayesha’s total excess (compulsory and voluntary) | £500 |

Insurer’s contribution | £900 |

Amount Ayesha must pay upfront | £500 |

Ayesha saves £180 annually for choosing the higher excess, but had to pay £500 instantly to get her car fixed. It wiped out the savings (and then some).

Had the damage been under £500, her insurer wouldn’t have paid anything.

Risk versus savings

According to Total Loss Gap, drivers who raise their voluntary excess from £250 to £500 save on average 27% on premiums, but risk losing more in the event of a claim.

Do you always pay the excess?

No, you don’t always have to pay the excess, but most of the time, you will. Whether you pay depends on who’s at fault, the type of claim, and even the insurer’s internal rules.

When you do pay

In most claims, your insurer will ask for the full excess (compulsory and voluntary). This includes:

- At-fault accidents

- Single-vehicle incidents (e.g. skidding into a post)

- Fire, theft, or vandalism claims

- Any claim where the other driver can’t be identified

For example, if your car is stolen and recovered with damage, you still pay your total excess, even if you weren’t behind the wheel.

According to Mawcomms, in 2025, the average theft excess is now £267, up 47% since 2020, while accidental damage/fire excesses average £234, up 26%.

When you might not pay

There are some exceptions:

- No-fault accidents: If the other driver is 100% at fault and your insurer recovers the full cost from their provider, your excess may be reimbursed.

- Glass-only claims: Many insurers waive excess (or apply a smaller one) for windscreen repairs or replacement.

- Excess protection insurance: A separate policy that covers your excess amount, usually for an annual fee.

However, initially, insurers almost always ask you to pay the excess up front. Any refund comes later, if at all, after liability is established.

Unless you're absolutely sure the other party is at fault and willing to admit it, assume you’ll be paying the excess. If you’re unsure, check your policy wording or call the insurer before making a claim.

So how much is the average voluntary excess in UK car insurance – and what does that mean for you?

In the UK, the average voluntary excess chosen by drivers tends to sit around £250 on top of what the insurer already requires. (rtaclaims.co.uk) While specific figures can vary widely depending on age, vehicle type, driving history and insurer, most guides indicate voluntary excesses commonly range from about £100 to £500. (Howden Insurance)

Be aware: choosing a higher voluntary excess can reduce your annual premium, but it also means you’ll have to pay more upfront if you ever claim. So the real question isn’t just “What’s average?” it’s “What can you afford without jeopardising your finances?”

Why are insurance excesses rising in 2025?

Insurance excesses are rising because claims are more expensive to settle, and insurers are passing that cost onto drivers.

Increases in repair costs, theft rates, and vehicle complexity have all pushed excesses higher in recent years.

The data behind the hike

According to analysis by Total Loss Gap, repair costs are up 17% since 2023 due to expensive EV components, advanced driver assistance systems (ADAS), and costly paint-matching.

At the same time, Insurance Edge said insurers paid out an estimated £11.7bn in motor insurance claims in 2024. To offset losses, many have raised excess levels rather than push premiums even higher.

This is especially true for:

- Theft claims, where average excess has increased 47% since 2020.

- Accidental damage/fire claims, up 26% in average excess value.

Young drivers hit hardest

New drivers, especially those under 2, face the steepest excesses. Many insurers now apply compulsory excesses of £300 or more to this age group, regardless of driving record or claim history.

This pushes the total payable excess to £600 or higher, making accidents financially punishing for young drivers trying to save on premiums.

Stat snapshot: Excess trends

Metric | Value (2025) | Source |

|---|---|---|

Average UK car insurance premium | £777 per year (down 17% year on year) | Total Loss Gap |

Average voluntary excess | £300 (up 10% since 2023) | Independent |

Drivers opting for £500 voluntary excess | 23% (up from 20% in 2022) | Independent |

Theft claim excess | £267 average (up 47% since 2020) | Mawcomms |

Insurer payouts in 2024 | £11.7bn | Insurance Edge |

Excess inflation is now baked into the system. It’s a way for insurers to shift risk, and for drivers to lower premiums upfront while gambling on not making a claim.

How much excess should you choose?

You should choose the highest voluntary excess you can realistically afford to pay out of pocket – without causing financial strain. It’s a balancing act between saving money upfront and avoiding a costly regret after a claim.

The financial tipping point

Raising your voluntary excess from £250 to £500 can save around 27% on your annual premium. But that saving often evaporates the moment you need to claim.

Let’s visualise this:

Voluntary excess | Annual premium | Claim cost | You pay | Insurer pays |

|---|---|---|---|---|

£100 | £925 | £1,200 | £350 | £850 |

£250 | £850 | £1,200 | £500 | £700 |

£500 | £675 | £1,200 | £750 | £450 |

*Assumes £250 compulsory excess across all scenarios

Who should set a low excess?

- New drivers with low savings.Parents adding children to their policy.

- Anyone who’s recently financed a car or is still paying it off.

- Drivers worried about sudden repair costs.

If you’re in one of these groups, a lower excess might cost more month to month, but it protects you from large surprise expenses.

And who can push it higher?

- Experienced drivers with emergency funds.

- Those with spotless driving records.

- People insuring second or infrequently used vehicles.

- Drivers who are comfortable managing risk in exchange for lower premiums.

If you can afford to pay £500 or £600 without financial stress, a higher excess could be a sensible trade-off.

Zego’s advice

For most drivers, especially younger ones, it’s not a question of what will save you money, it’s what won’t break you if things go wrong. If a £500 bill would seriously disrupt your finances, don’t set that as your voluntary excess.

What’s the risk of choosing a high excess?

The main risk of a high excess is that it makes claiming unaffordable, so you either avoid claiming altogether or absorb the entire cost yourself. What felt like a smart saving can become a painful false economy.

The false economy trap

Here’s how it typically plays out:

- You raise your voluntary excess to £500 and save £150 on your premium.

- Six months in, someone reverses into your parked car.

- The repair quote is £800.

- You now have to pay £500 (voluntary) + £250 (compulsory) = £750 just to access your insurer’s £50 contribution.

Result? You don’t claim. You pay the full £800. That original £150 saving? Gone – plus an added £650 of stress.

This is more common than you think.

In a 2025 market study by Independent, Mawcomms said 23% of drivers now select a £500 voluntary excess, despite rising accidental damage costs averaging £234.

When you might regret a high excess

- Low-speed scrapes and scratches (often under £1,000).

- Single-vehicle accidents (e.g. curb hits, reversing into poles).

- Fire or theft claims where you assumed full coverage.

- Third-party-at-fault situations where liability takes months to resolve.

How can you save on car insurance without raising your excess?

You can reduce your car insurance costs without increasing your excess by using a black box policy, cutting annual mileage, improving your vehicle’s security, or switching providers regularly.

These tactics lower risk in the eyes of insurers, without gambling on unaffordable claim costs.

1. Telematics (black box insurance)

For new drivers, telematics insurance is often the single most effective way to cut premiums, especially when keeping excesses low.

Telematics policies monitor how, when, and where you drive. Good driving ratings mean discounts, safer journeys, and potentially lower compulsory excess levels. According to Confused.com, young drivers using black box policies save up to £300 plus per year on average compared to standard cover.

2. Reduce Annual Mileage

The less you drive, the less risk you pose. If you can accurately estimate and cap your annual mileage, especially under 7,000 miles, you may unlock lower premiums without tweaking your excess.

But it’s important to be honest. Under-reporting mileage is a fast track to voided claims.

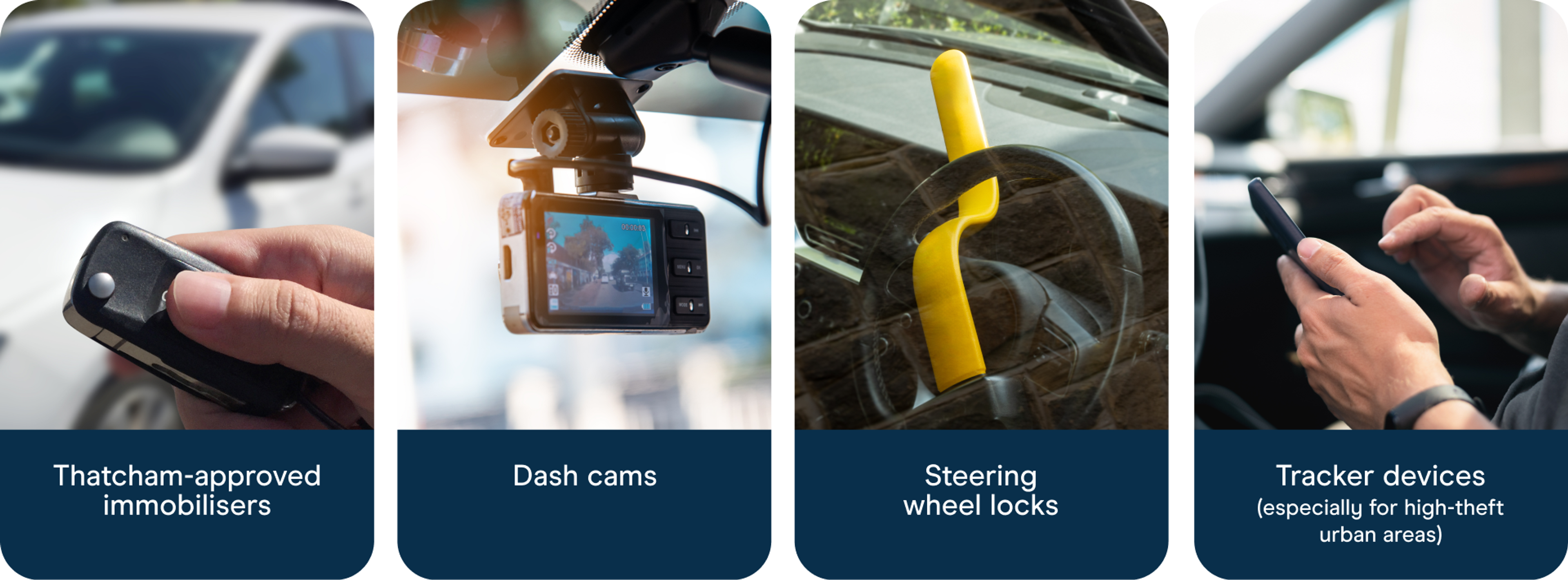

3. Improve your vehicle security

You can improve your vehicle security by installing the following:

- Thatcham-approved immobilisers

- Dash cams

- Steering wheel locks

- Tracker devices (especially for high-theft urban areas)

Adding these can reduce theft risk and keep both premiums and excesses lower, particularly on comprehensive policies.

4. Shop around

Loyalty rarely pays. Use price comparison tools, switch providers annually, and double-check coverage limits, excess amounts, and hidden charges.

This can easily save hundreds without compromising your financial cushion.

Do parents need to worry about their child’s excess?

Yes, parents insuring young drivers must watch out for high compulsory excesses, which often go unnoticed until a claim is made. Sometimes, the cheapest policy can leave you hundreds worse off after even minor accidents.

Case example: Adding a teen driver

Let’s say you add your 18-year-old daughter to your own comprehensive policy. The quote drops if you agree to a £250 voluntary excess and a £400 compulsory young driver excess. That’s £650 total.

She bumps the car pulling out of a junction and repairs cost £900.

Suddenly, your family pays £650 just to make the claim. Add your £200 no-claims discount lost next year, and you’ve effectively paid out more than the repair cost.

It’s easy to miss this when rushing to get cover for a new driver.

Tips for parents

- Always check the total excess on a multi-driver policy (don’t assume it’s shared evenly).

- Consider standalone policies for young drivers using black box cover.

- Don’t be afraid to call insurers directly to clarify excess terms, especially for theft, windscreen, and accident claims.

What if you can’t afford to pay the excess?

If you can’t afford your excess, you’ll either have to pay the full repair cost yourself, or forfeit your ability to make a claim. That’s why it’s essential to know this number before you need to use it.

Solutions if you’re caught short

- Excess Protection Insurance

A separate policy that refunds your excess after a claim. It usually costs £20–£40 a year and is worth exploring – especially for policies with £500+ total excess. - Ask about payment plans

Some repair centres or insurers may offer instalment options. These aren’t widely publicised, but if your claim is approved, it’s worth asking. - Decline the claim

If the damage cost is close to or below your total excess, it might make more sense to avoid the claim entirely. But that only works if you can cover the repair cost upfront.

Safety net reminder

Your excess is your financial safety net. If you set it too high to save £10 a month, it could cost you hundreds later. Make sure it's a number you’d be able to pay within 24 hours – not one that would send you into debt.

Summary: What matters most about excess in 2025

- You’ll almost always pay excess, know the total amount in advance.

- Don’t confuse ‘lower premium’ with ‘better deal’ if the excess is unaffordable.

- Excess levels are rising, especially for younger drivers and theft claims.

- Consider alternatives to saving on premiums, such as black box policies or switching providers, before raising your excess.

- Always balance premium savings with real-world risk. If the numbers don’t add up after a crash, they don’t add up at all.