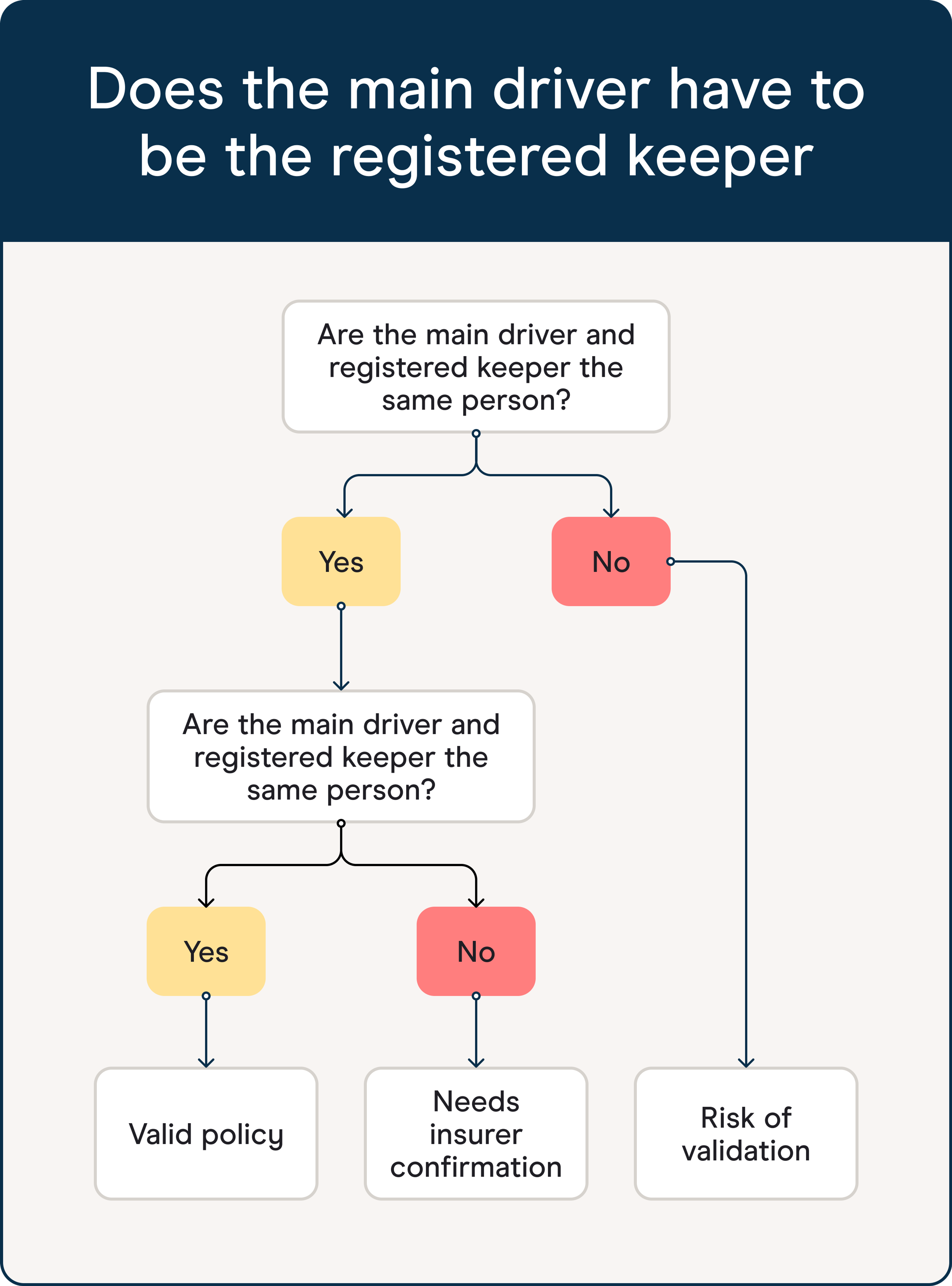

Many drivers find themselves asking the same question when insuring a car, especially for the first time or when sharing a vehicle with family – does the main driver have to be the registered keeper?

No, in the UK, the main driver does not have to be the registered keeper of a vehicle. As long as the insurer is accurately informed about who drives the car most often, the main driver and the registered keeper can be different people. However, misrepresenting the main driver to reduce premiums, known as fronting.

Even if this is unintentional, this can result in void policies, rejected claims or, in serious cases, accusations of fronting.

What’s the difference between the main driver and the registered keeper?

The registered keeper is the person responsible for the vehicle in the eyes of the DVLA. They’ll receive tax reminders, speeding tickets and parking fines. Their name is on the V5C logbook. But that doesn’t necessarily mean they drive the car the most.

This is corroborated by West Yorkshire Police, who state: “A registration document (V5) is not proof of ownership. The registered keeper should be the person who is actually using/keeping the vehicle and this is not necessarily the owner of the vehicle or the person who is paying for it.”

The main driver is whoever uses the vehicle more than anyone else. That could be the keeper, or it could be a completely different person. And it’s the main driver’s details – not just the registered keeper’s, that insurers use to assess risk and set premiums.

This distinction is important, and it’s very common for these roles to be split.

The UK Government state that during the course of 2023, there were:

- 2.5 million vehicles registered for the first time.

- 342,000 zero emission vehicles registered for the first time.

- 314,000 zero emission cars registered for the first time.

At the end of December 2023, in the UK there were:

- 41.2 million licensed vehicles.

- 1 million licensed zero emission vehicles.

Can someone insure a car they don’t own, or aren’t the keepers of?

Yes, in many cases, someone can insure a car they don’t own or aren’t listed as the registered keeper. It depends on the insurer and the policy details. What matters most is that the person being insured has what's known as an insurable interest, a clear reason to need cover for that vehicle.

This happens all the time. Parents may insure a car used by a child. One partner may own the car, but the other drives it daily. An employee might insure a car leased or registered by their company. These are all scenarios insurers are used to, but they do expect you to be upfront about the situation.

While some policies only allow the policyholder to be the keeper, many will accept different arrangements. If you’re unsure, the best move is always to ask the insurer directly and avoid assumptions. For more, see our article on insuring a car you don’t own.

Is it illegal to have different names on the documents?

No, it’s not illegal to have the registered keeper, legal owner and main driver listed as different people. But it can cause problems if the information given to the insurer doesn’t reflect the real use of the car.

If, for example, you tell your insurer that you’re the main driver to reduce the cost, when in reality your child drives the car most of the time, the policy may be void. That’s not just a technicality. If you need to make a claim and the insurer finds the declared main driver wasn’t the actual one using the car day to day, they may reject the claim entirely.

What is fronting, and why is it a problem?

Fronting is when someone, normally a parent, declares themselves as the main driver of a car to get cheaper insurance, even though someone else (often their child) uses it more often. It’s a form of insurance fraud, even if the intention is to save money rather than deceive.

The Association of British Insurers said that in 2022, insurers detected 72,600 dishonest insurance claims valued at £1.bn.

“It is estimated that a similar amount of fraud goes undetected each year. This is why insurers invest at least £200m each year to identify fraud,” they added.

Fronting can lead to cancelled policies, refused claims and legal trouble. It may even leave the real driver without cover during a claim.

It’s safe to assume that a lot of first-time drivers rely on parental help when getting on the road, including insurance, ownership or registration.

That support is legitimate when set up properly. But if parents are listed as the main driver to reduce costs and the insurer later finds the child is the one primarily using the car, the entire policy may be invalid.

When is it fine for the main driver and registered keeper to be different?

There are plenty of legitimate scenarios where these roles are different – and insurers are generally comfortable with that, as long as they know.

Some typical examples include:

- A company car, where the business is the registered keeper but the employee drives it most days.

- A learner driver using a parent’s vehicle for practice.

- Couples who share a car, but where one partner drives most of the time.

- A family car kept at a different address for practical reasons.

Common scenarios and their validity

This table outlines a few everyday insurance scenarios where the registered keeper and main driver may differ. It shows whether each setup is typically considered valid by insurers, depending on how it's declared.

Scenario | Registered keeper | Main driver | Is it valid? |

|---|---|---|---|

Parent owns car, child drives daily | Parent | Child | Yes, if declared properly |

Couple shares car, one drives 90% | Partner A | Partner A | Yes |

Parent declares themselves, but child drives mostly | Parent | Child | No, this is fronting |

The Society of Motor Manufacturers and Traders says that over 41.2 million vehicles were licensed for road use in the UK in 2023 – including more than five million vans and 625,000 heavy goods vehicles – highlighting the range of ownership and usage arrangements on British roads.

What do insurers really want to know?

Insurers are focused on risk. They want to know:

- Who drives the car most of the time?

- Where is the car kept overnight?

- What is the vehicle used for (commuting, social, business)?

- Whether the provided information reflects real-world use?

If those answers are accurate, it often doesn’t matter who is listed on the logbook. But if they aren’t, you risk invalidating your insurance at the moment you need it most.

Auto Repair Focus said that as of 2023, the average UK car is now nine years old. Its chief executive, Stuart James, added: “Given the current average age of cars in the UK now standing at nine years and lower scrappage rates, it is clear that drivers are opting to hold onto their vehicles for longer periods. This dynamic presents a significant opportunity for the Independent Garage Sector to thrive.”

You don’t have to be the registered keeper to be the main driver, and you don’t have to be the legal owner to insure a car. But you do need to be clear and honest with your insurer about who is actually driving the car most of the time.

If you're looking for flexible, app-based cover as a new driver, you can learn more about Zego's telematics car insurance

For tips on what kind of vehicles cost less to insure, check out our guide to the cheapest cars to insure for new drivers.

Looking for car insurance?