The shock of getting your first car insurance quote as a 17-year-old is something of a rite of passage in the UK. You've passed your test, saved up for a modest first car, and then reality hits when you see quotes ranging from £2,000 to a mind-boggling £8,000.

It's enough to make you question whether driving is worth it at all. One young driver (@lentini) recently shared on X that they were quoted £3,000 for a 1.2L Vauxhall Adam, a car worth barely £4,000 itself.

Another (@bonkerssteve) described insurance costs as “basically a second car payment,” with premiums reaching £2,500 when added to a parent's policy.

So, why are 17-year-olds being hammered so hard by insurers, and what can actually be done about it? We’ve gathered some real examples, practical tips, and community advice to help you navigate this expensive milestone without breaking the bank.

Why are insurance premiums so expensive?

The numbers are genuinely shocking. The average car insurance cost for a 17-year-old driver in the UK is currently £1,752, according to recent data from NimbleFins. But averages only tell part of the story.

What you'll actually pay varies dramatically based on where you live, what you drive, and even seemingly random factors like your job title or where you park overnight.

There are three main reasons why insurers charge 17-year-olds so much. First, the risk factor. Young drivers are statistically more likely to be involved in accidents, that's just the data. Insurance companies, therefore, look at these numbers and see pound signs.

Second, unless you purchased a learner insurance policy, you wil have got no driving history with an insurance company. With zero no claims bonus (NCB), insurers have nothing to go on except your age group's general statistics, which, as we've seen, aren't great.

Third, young drivers tend to choose cars that are either popular targets for theft (like the Ford Fiesta) or have relatively powerful engines for their size and weight. Both factors drive up premiums significantly.

But here's the thing, these factors aren't entirely fixed. There are ways to work around them.

How much is car insurance for a 17-year-old in the UK?

The average cost of insurance for a 17-year-old is between £1,700–£2,500 a year, but quotes vary widely by car, postcode, mileage and driving history. You can often lower this with a small-engine, low-group car and a telematics insurance policy like Zego Sense.

Five surprising things that impact the cost

Location matters

Location makes an enormous difference. A 17-year-old female driver from rural Somerset reported on r/UKPersonalFinance that she secured insurance for £1,200 on a Volkswagen Up, while her friend in Manchester faced quotes starting at £3,000 for the same car. The rural/urban divide is stark, postcodes in Birmingham, Manchester, and London typically see premiums 40-60% higher than rural areas.

Car choice: the biggest factor

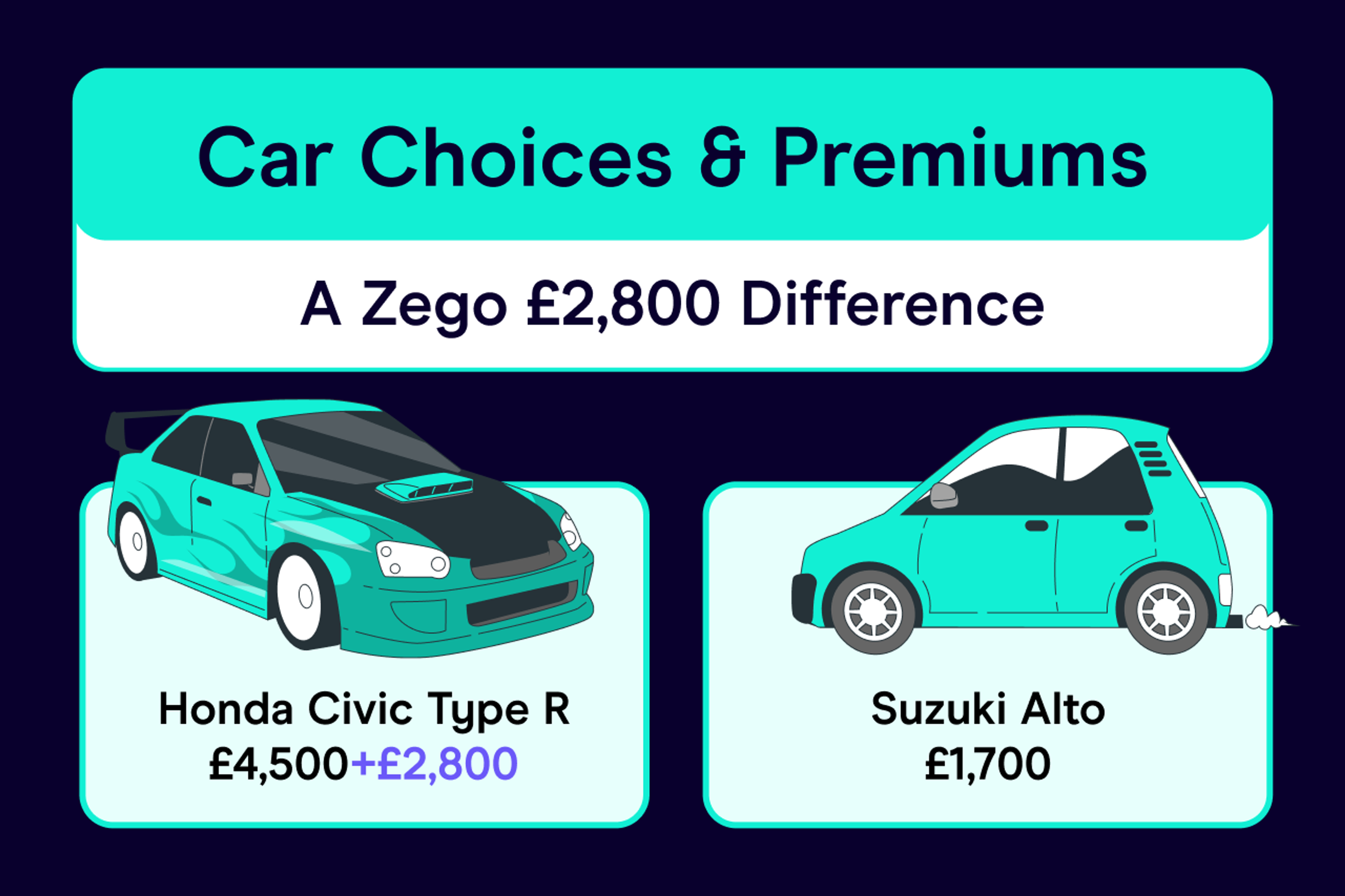

Car choice remains the biggest variable. A 19-year-old Reddit user switched from a Honda Civic Type R (£4,500) to a Citroen C1 (£1,700), saving £2,800 annually. Another found that a 10-year-old Toyota Aygo (£1,900) was far cheaper to insure than a newer Ford Fiesta (£3,200) despite the Fiesta being worth only slightly more.

Time of year and renewal date

Many young drivers don't realise that when you buy insurance can significantly impact the premium. According to MoneySavingExpert, the cheapest time to get quotes is 26 days ahead of your renewal date – making it the best time to get a quote as your cover becomes more expensive the closer you get.

Its analysis of over one million quotes from January to April 2024 from MoneySupermarket showed that policies cost an average of £2,277 a year on renewal day. However, just 26 days prior, the average was just £906 a year – a big difference of £1,371 less.

Best cars for 17-year-olds to insure based on cost

1) Volkswagen Up (plus Skoda Citigo / SEAT Mii)

Why it’s good: Simple 1.0-litre engines, light weight, easy to drive, huge parts availability.

Best spec to target: 1.0 MPI, entry trim, standard wheels, unmodified.

Why it’s cheap to insure for 17-year-olds: The Up/Citigo/Mii family often sits in lower insurance groups, making it a good option for 17-year-olds due to its lower cost of insurance versus larger hatchbacks.

Watch-outs: Avoid GTI/“warm” variants, bigger alloys, and any performance or cosmetic mods.

2) Toyota Aygo / Peugeot 108 / Citroën C1 (newer triplets)

Why it’s good: Tiny footprint, frugal engines, cheap tyres, loads on the used market.

Best spec to target: 1.0 petrol (VVT-i/EB2), base trim, stock wheels.

Why it’s cheap to insure for 17-year-olds: These city-car triplets are known for low insurance group versions, making them cheap to insure for 17-year-olds who want predictable running costs.

Watch-outs: Skip “special edition” style packs and any aftermarket tweaks.

3) Hyundai i10

Why it’s good: More refined than many city cars, trustworthy reliability.

Best spec to target: 1.0 MPI, entry or mid trim without sport packs.

Why it’s cheap to insure for 17-year-olds: Lower-power 1.0 engines typically fall into lower insurance groups, giving a lower cost of insurance for 17-year-olds than bigger, heavier superminis.

Watch-outs: 1.2 engines and dress-up packs can push groups up.

4) Kia Picanto

Why it’s good: Same winning recipe as i10; simple to maintain, widely available.

Best spec to target: 1.0 petrol, base trim.

Why it’s cheap to insure for 17-year-olds: The Picanto’s small, non-turbo engines and light body help keep premiums low for 17-year-olds, especially in entry specs.

Watch-outs: Avoid GT-Line/“sporty” packages and bigger wheels.

5) Suzuki Alto

Why it’s good: Ultra-light, minimal running costs, perfect city doddler.

Best spec to target: 1.0 petrol, simplest trim, no mods.

Why it’s cheap to insure for 17-year-olds: Its basic 1.0 engine and light weight often place it in lower insurance groups, so it’s cheap to insure for 17-year-olds starting out.

Watch-outs: Any modification (even cosmetic) can hike quotes.

6) Suzuki Celerio

Why it’s good: Practical cabin for its size, easy upkeep, honest mechanicals.

Best spec to target: 1.0 petrol, base trim, standard wheels.

Why it’s cheap to insure for 17-year-olds: A straightforward drivetrain and low repair costs make the Celerio a good option for 17-year-olds due to its lower cost of insurance.

Watch-outs: Fancy styling packs can nudge premiums.

7) Fiat Panda

Why it’s good: Boxy practicality, cheap parts, plenty of tidy base-spec cars.

Best spec to target: Entry trims (Pop/Easy-type), smaller wheels, basic petrol.

Why it’s cheap to insure for 17-year-olds: Base Pandas with small engines are typically lower insurance group choices, giving lower insurance costs for 17-year-olds than sportier superminis.

Watch-outs: Avoid 4x4/TwinAir or anything “adventure” styled for year one.

8) Dacia Sandero

Why it’s good: Excellent price-to-age ratio, simple engines, easy repairs.

Best spec to target: 1.0 SCe (non-turbo), Access/Essential-type trims.

Why it’s cheap to insure for 17-year-olds: The basic Sandero is cheap to insure for 17-year-olds thanks to simple, low-power engines and lower parts costs versus premium brands.

Watch-outs: Stepway styling/turbo variants can increase group and price.

9) Ford Ka+

Why it’s good: Roomier than most city cars but still simple and cheap to run.

Best spec to target: 1.2 Duratec, Studio/entry trim.

Why it’s cheap to insure for 17-year-olds: The Ka+ in modest trims usually sits in lower insurance groups, providing a lower cost of insurance for 17-year-olds who need extra space.

Watch-outs: Larger wheels and dress-up kits can push premiums.

10) Vauxhall Viva

Why it’s good: Compact, straightforward 1.0 petrol, easy ownership.

Best spec to target: SE-type entry trim, standard equipment.

Why it’s cheap to insure for 17-year-olds: Entry-level Vivas are commonly cheap to insure for 17-year-olds, as insurers favour unmodified, low-power city cars.

Watch-outs: Avoid “S-line”-style cosmetic packs and any undeclared extras.

11) Nissan Micra (older generations best: K12/K13)

Why it’s good: Simple 1.2 petrols, plentiful parts, unmodified examples are easy to find.

Best spec to target: 1.2 petrol, base/mid trim without sport packs.

Why it’s cheap to insure for 17-year-olds: The Nissan Micra is a good option for 17-year-olds due to its lower cost of insurance in earlier, lower-power trims that often land in lower insurance groups.

Watch-outs: Skip SR/“sport” variants or newer turbo models.

12) Renault Twingo (2014-on)

Why it’s good: City-car focus, nimble and easy to park; basic 1.0 works well.

Best spec to target: 1.0 SCe, entry trim, stock wheels.

Why it’s cheap to insure for 17-year-olds: In base form, the Twingo’s low output and light weight make it cheap to insure for 17-year-olds, especially compared with turbo micro-hatches.

Watch-outs: 0.9 TCe turbo and style packs can increase the group.

Cheapest insurance groups

The single biggest decision affecting your premium will be your choice of car. Here's what to look for if you want affordable insurance:

Low insurance group cars in groups 1-5 are your best friends as a 17-year-old. These include:

- Volkswagen Up (groups 1-4)

- Skoda Citigo (groups 1-2)

- Hyundai i10 (groups 1-4)

- Suzuki Alto (group 3)

- Fiat Panda (groups 1-5 depending on model)

Find out which are the cheapest cars to insure

Essentially, you want small cars with small engines (1.0L-1.2L), basic trim levels, and good safety ratings. Older models (three-to-five-years-old) often cost less to insure than brand new ones, partly because they're worth less if written off.

Avoid ‘popular with young drivers’ cars like the plague. The Ford Fiesta, Volkswagen Polo and Vauxhall Corsa might be common first cars, but they're expensive to insure precisely because they're popular with your age group, and therefore involved in more accidents.

Also, steer clear of any car with modifications, even small ones. That includes bigger alloys, body kits, or performance upgrades. Each one sends your premium skyrocketing.

Practical money-saving strategies

Beyond choosing the right car, there are several proven ways to bring down those astronomical quotes. Here are some ways to help save on costs:

Telematics or black box insurance

Telematics (or black box insurance) policies can save 17-year-olds up to 40% on their premiums on average.

These policies monitor your driving style, rewarding safe drivers with lower costs at policy purchase and renewal, potentially saving you thousands of pounds. In the past, traditional black boxes have had to be physically fitted into your car, but new technology means insurers are able to monitor your driving via apps, and this is called telematics.

Adding experienced drivers to your policy

Adding a parent or experienced driver as a named driver can significantly reduce premiums. However, they cannot be the main driver, and lying about this is called ‘fronting’, which is illegal.

However, and concerningly so, the Insurance Fraud Bureau reported that in 2023, there was evidence to suggest 27% of 18-to-24-year-olds would find it acceptable to lie on an insurance application to save money, and 22% of 25-34-year-olds would do the same.

Ursula Jallow, director at IFB, warned: “Opportunistic fraud has serious consequences for those who are dishonest, which includes being placed on the Insurance Fraud Register and facing a potential criminal conviction.”

The key is to be honest about who the main driver is. If you're the one using the car most often, you must be listed as the main driver – even if it costs more.

Shop around, then call and haggle

Use comparison sites like Compare the Market and Confused.com to shop around for prices – but don't stop there. Some insurers like Direct Line don't appear on comparison sites, and specialist young driver insurers might offer better deals directly.

Once you've got your best quote, call and try to haggle. Insurers have more wiggle room than they admit, especially if you've got competing quotes.

One driver on MoneySavingExpert reported their renewal quote dropping from £690 to £575, while a new quote from Tesco was £425. Once ringing up their current insurer, and explaining how they wanted to stay with them, their renewal quote dropped to £423 – a saving £152 with no changes to the policy.

Job titles matter

The way you describe your job can legitimately affect your premium by hundreds of pounds. For example, ‘chef’ might result in a higher quote than ‘kitchen staff’ or ‘catering assistant' – despite being essentially the same job.

MoneySavingExpert's research found differences of up to £500 based solely on job title. Always try different (but accurate) descriptions of your occupation when getting quotes.

Most expensive UK job titles for car insurance

Occupation | Average monthly premium price |

|---|---|

Construction worker | £233.20 |

Barber | £228.42 |

Security guard | £225.58 |

Builder | £218.01 |

Company director | £216.19 |

Unemployed | £215.91 |

Security officer | £212.25 |

Managing director | £209.04 |

Cheapest UK job titles for car insurance

Occupation | Average monthly premium price |

|---|---|

Police officer | £116.35 |

Human resources staff | £129.52 |

Soldier | £133.42 |

Local government officer | £134.95 |

Civil servant | £136.05 |

Marketing manager | £139.00 |

Human resources manager | £139.78 |

Project coordinator | £141.86 |

Administration officer | £143.69 |

Postman | £144.13 |

Source: MoneySuperMarket. Based on comprehensive car insurance policies purchased between 31/01/2024 and 31/01/2025 for policyholders aged 30–40 with a UK licence for over 1 year and no named drivers.

Building your no claims bonus

The single most valuable thing you can do as a new driver is build your NCB. Each year of claim-free driving can reduce your premium by 30% or more.

Here are some tips to protect your valuable NCB:

- Consider paying for minor damage out-of-pocket rather than claiming

- Add NCB protection once you have two plus years (though this costs extra)

- Check if your NCB is transferable if you change insurers (most are)

The harsh reality is that the first one to two years will be expensive; there's no magic solution to completely avoid that. But if you choose your car wisely, use telematics like Zego Sense, and build your NCB, you'll see dramatic improvements by age 19-20.

Final thoughts

Yes, new driver car insurance for 17-year-olds in the UK can be expensive. But with careful planning and the right strategy, you can bring costs down to a more manageable level.

The most successful approach combines:

- Choosing a small-engined car in a low insurance group

- Using a telematics or black box policy to prove you're a safe driver

- Adding experienced named drivers to your policy

- Comparing quotes extensively and getting them 26 days early

- Being patient and focused on building your NCB

Remember that while the initial costs seem outrageous, they do improve significantly over time. That first year is painful, but it's your ticket to the freedom and opportunities that come with being able to drive.

Looking for car insurance?