NEW DRIVER INSURANCE

Personalised premiums for new drivers

Our app-based telematics, Sense, gives you a personalised quote at renewal

No need to install anything – simply download the Sense app!

Designed help new drivers secure the best possible policy

How does Zego's New Driver insurance work?

Insurance for new drivers

Drive safely and you could pay less sooner than you would by building your no claims discount.

Telematics insurance for New Drivers

Sense is currently available for drivers on our car insurance.

How Zego’s telematics works

With Zego Sense, there is no physical black box required.Your driving data is collected through your smartphone

The app monitors your driving over time using sensors

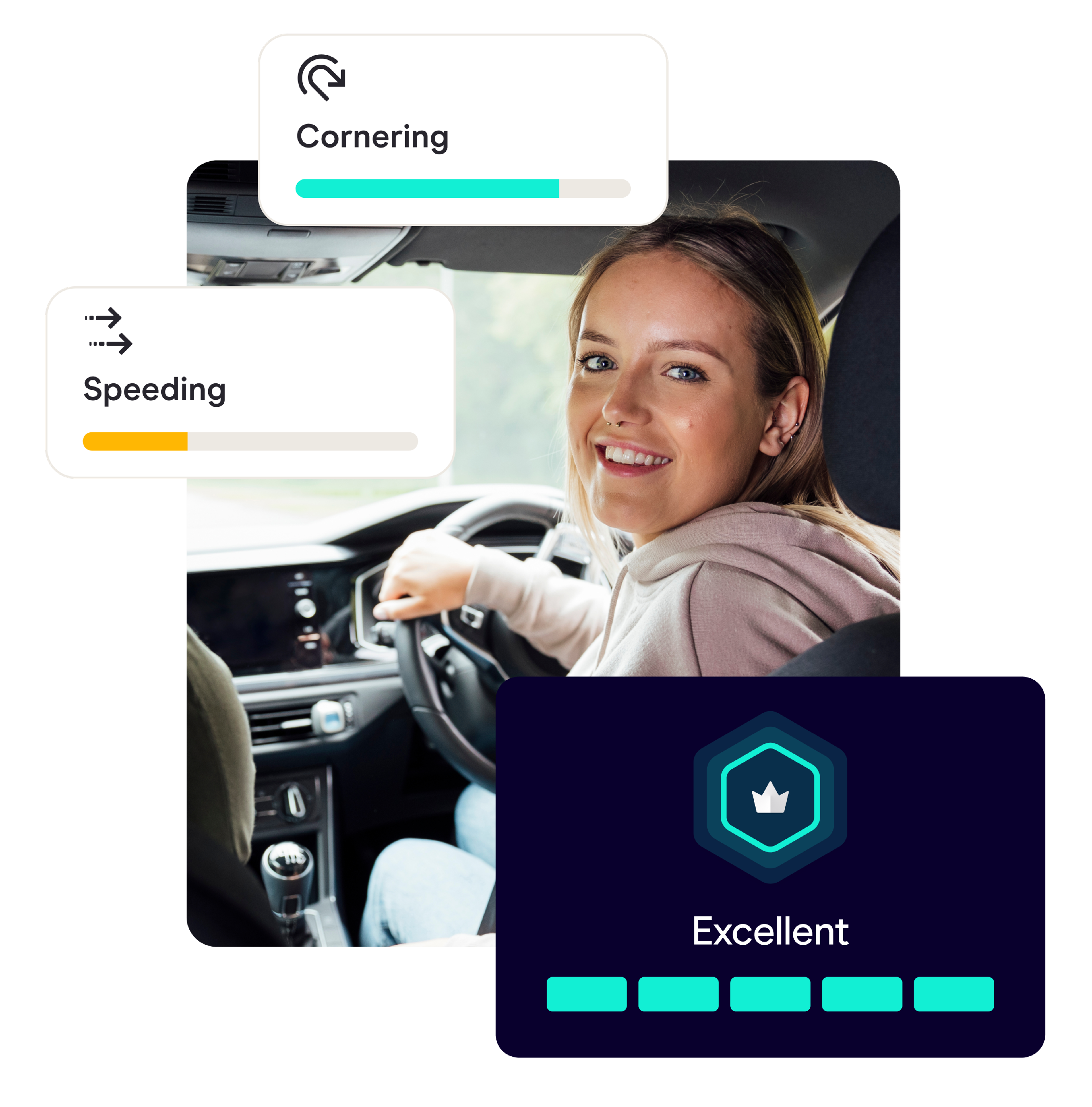

Your driver rating reflects your habits

Higher driver ratings earn you a personalised renewal quote

Easy and quick to download

Why choose Zego Sense?

Zego Sense gives you a bespoke renewal premium based on how well you drive.Price based on your personal driving habits

Monitor your driving in real time via the app

Tailored policies designed just for you

Access flexible policies at the touch of your phone

No need to install a black box!

How to get started

Signing up couldn’t be easier, simply secure your quote and download the app!Get a quote online and choose the type of cover you want

Pick a Sense policy

Download the app and switch on permissions

The app measures how well you drive over time

This will influence your renewal price

Is new driver telematics insurance right for me?

Sense recognises safe driving by rewarding responsible drivers, regardless of their age or experience.

Young drivers often face higher premiums due to inexperience. Our app-based telematics, Sense, tracks driving habits and rewards safe driving no matter what your age.

Telematics policies can also offer lower premiums for low-mileage drivers who don’t drive much, as insurance costs are partially based on mileage and usage.

Safe drivers can benefit from premiums that take into account good driving habits like smooth braking and cornering.

How does a telematics device or black box work?

Whether you use app-based telematics, like Sense, or a physical black box, both are designed to track your driving behaviour, rewarding you with personalised premiums.

With app-based telematics, your smartphone’s sensors track key driving factors like speed, braking, acceleration, cornering and rest. Alternatively, a physical black box installs directly into your car, providing data for accurate pricing.

Choose an app-based telematics policy today with Sense to enjoy personalised insurance rates, real-time feedback, and the peace of mind that comes with knowing you're paying only for the coverage you need.

Your driver rating

Measures how well you’re driving

Your driver rating is a reflection of how safely you drive. Based on factors like speeding, braking, cornering, acceleration and rest, this driver rating helps determine your premium.Driving habits

Adopt safe skills

Harsh braking, rapid acceleration, and speeding can lead to a bad driving rating. Poor driving habits not only increase your risk on the road, but can also raise your insurance premiums.Cornering, speed & braking

Maintain control

Fast cornering, excessive speeding, and harsh braking can all negatively affect your driver rating. Smooth driving leads to better safety.Reviewing your journeys

Assess your performance

With Sense, you can review each journey and get insights into your driving habits. Check your driver rating regularly to spot areas for improvement.

What insurance do new drivers need?

This type of insurance protects you and other road users if you’re involved in an accident. Our car insurance is fully comprehensive, this means you get all the cover you need to start driving.

What level of cover do I need?

Fully comprehensive

If you’re involved in an accident, this type of policy protects you and your vehicle, plus other people and their property. It’s the top level of insurance, for that extra peace of mind.

What affects the cost of car insurance?

Your age

New and young drivers tend to pay the most for their insurance. That’s because, statistically, these drivers are more likely to be involved in an accident.Your driving history

As a new driver, it’ll take a few years to build your No Claims Discount. Until then, you’re likely to pay more for your cover. Also, if you receive any motoring convictions, your insurance costs could go up even more.Your car

Cars that are more powerful and more expensive to buy or repair usually cost more to insure. Also, if your car has been modified, it can also drive up the cost of your cover.

Where you live

If you live in an area with a high rate of vehicle theft or vandalism, the cost of your insurance could go up, too. That’s because the risk of your car being stolen or damaged is higher.

How to pay less for insurance as a new driver

Choose the right car

The car you drive can make a big difference to your insurance costs.

Insurers typically work out the price of your policy using insurance groups, ranging from 1 to 50. Vehicles that are more powerful and expensive to repair or replace tend to fall into a higher group, which means a higher cost to insure.

By choosing a modestly priced vehicle, with a smaller engine and good range of security features, you can help to lower your insurance risk, and the cost of your cover.Choose a telematics policy

Telematics is a type of technology that measures how well you drive. By driving safely, you can prove to your insurer that you’re a good driver.

For new drivers, it’s a clever way to start paying less for car insurance sooner, especially while you build your no claims discount.

Zego Sense is our telematics policy. Unlike similar policies, you don’t need to install a black box device in your car — everything is done through our easy-to-use app. Simply buy your policy, download the app and start driving. Easy!

Here’s what you get with our new driver car insurance

- Legal cover up to £100,000 to help with motoring-related disputes, personal injury claims, and more

- Personal accident cover up to £5,000

- Key and lock cover up to £500

- Cover for the loss, damage or theft of your vehicle and its spare parts

- Personal belongings cover up to £300

- Audio, communication and navigation equipment cover up to £500

- Costs for causing damage to other vehicles or property up to £5m

- Windscreen cover (£25 excess for repairs or £150 for replacement)

- Courtesy vehicle while yours is being repaired (with an approved repairer)

Upgrade your personal car cover with these extras

Breakdown cover

Combined roadside, recovery and home cover within the UK.£34.99

CAR TELEMATICS INSURANCE

Insurance that moves with you. It starts with Sense.

100% app-based telematics policy – no black box needed

Premiums based on how you drive, not just your age or job title

Get real-time driving insights sent straight to your smartphone

Manage your policy anytime in the Sense app

What do I need to get a quote?

- You’re 25–60 years old

- You live in the UK

- You have no previous claims or motoring convictions

- You hold a full UK driver’s licence

- Your car is valued at less than £30,000

- You agree to download and activate our Sense app on your phone

How do we calculate your car insurance price?

A higher driver rating means a lower price when you renew. So, by driving safely, you could pay less for your cover. It’s car insurance for good drivers.

Why we're the right choice

81m

575k

96%

Frequently asked questions

Trusted by 100,000’s of UK drivers

Share and earn. It's that simple.

That’s £50 if they take out an annual policy, or £10 for a 30-day one. The more friends you refer, the more you earn.

Excludes flexible, pay-as-you go customers

“81 million...” – Based on the total number of policies sold by Zego as of 23/07/25

“575K drivers...” – Based on the number of fixed policies sold by Zego as of 23/07/25

“96%..” – Based on Zego customers who have been insured on Sense policies and have a driver rating, between 01/06/2025 and 01/08/2025