UK Food Delivery Market Statistics

This report dives deep into the market's current state, emerging trends, and projected growth, providing detailed insights into user behaviours, platform dynamics, and the impact of technology.

(2024)

Market Overview

Market Size and Growth

Within the food delivery market, the meal delivery segment is a significant driver, projected to generate £48.21 billion in revenue by 2024 [2]. This segment includes traditional takeaway orders as well as new innovations like dark kitchens (delivery-only restaurants) and virtual brands.

User Demographics and Spending

On average, UK households spend approximately £6.40 per week on takeaways, translating to around £820 annually per person [4]. This high level of spending indicates how embedded food delivery has become in everyday life, particularly among younger generations.

Gen Z and Millennials Driving Growth

- 69% of Gen Z consumers (those born between the mid-1990s and early 2010s) use food delivery apps regularly [5].

- Gen Z orders food via delivery 4.5 times per month, outpacing other age groups [5].

- 63% of individuals aged 18-29 have used a food delivery app in the past 90 days [6].

Millennials, while not as frequent users as Gen Z, tend to spend more per order, averaging £60+ per transaction. However, both groups are united in their desire for healthier, eco-friendly options, contributing to a broader shift in the market [7].

Popular Platforms

The UK food delivery market is dominated by three major players: Just Eat, Deliveroo and Uber Eats.

45%

of the market

Just Eat is the most established and trusted brand, focusing on traditional takeaway and expanding its reach across urban and rural areas.

27%

of the market

Deliveroo leads with its premium services, including partnerships with high-end restaurants and its dark kitchen model (Deliveroo Editions), where meals are prepared specifically for delivery.

27%

of the market

Uber Eats is celebrated for its user-friendly interface and fast delivery times, with an extensive selection of both local and international restaurants.

Consumer Behaviour & Spending Trends

Spending Patterns

Consumers are also more likely to order food delivery during peak times, with Friday at 6 PM being the most popular time for deliveries [10]. Special occasions, such as Mother’s Day, New Year’s Eve, and Halloween, see the highest surge in food orders [11].

Top Food Choices

- Pizza

- Chinese cuisine

- Indian cuisine [12]

Key Market Trends

Technological Advancements

Platforms like Deliveroo and Uber Eats are leveraging artificial intelligence (AI) to optimize delivery routes, predict demand, and offer personalized recommendations based on past orders. This use of AI is significantly improving operational efficiency and customer satisfaction [14].

Drone deliveries are also on the horizon. Platforms are experimenting with drone technology to reduce delivery times in urban areas. Uber Eats is leading the charge in this space, with trials underway to integrate drones into their delivery fleet [15].

Impact of Remote Working

Sustainability and Healthier Choices

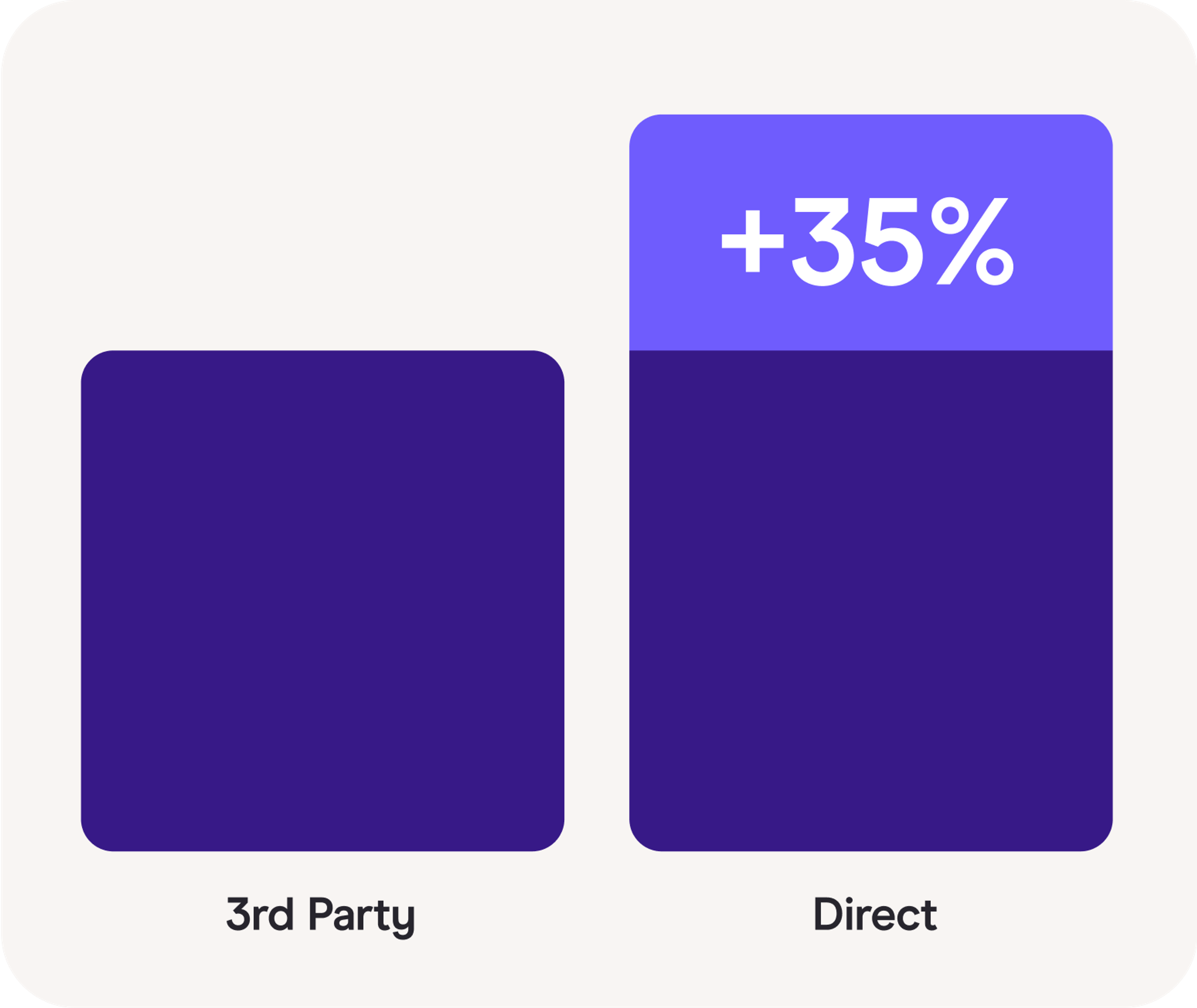

This trend towards sustainability is also influencing the rise of direct-to-consumer models, where consumers order directly from restaurants rather than through third-party platforms. These direct orders not only support local businesses but also allow consumers to make environmentally conscious decisions by reducing the carbon footprint associated with delivery logistics [18].

Future Projections and Growth

Key Takeaways

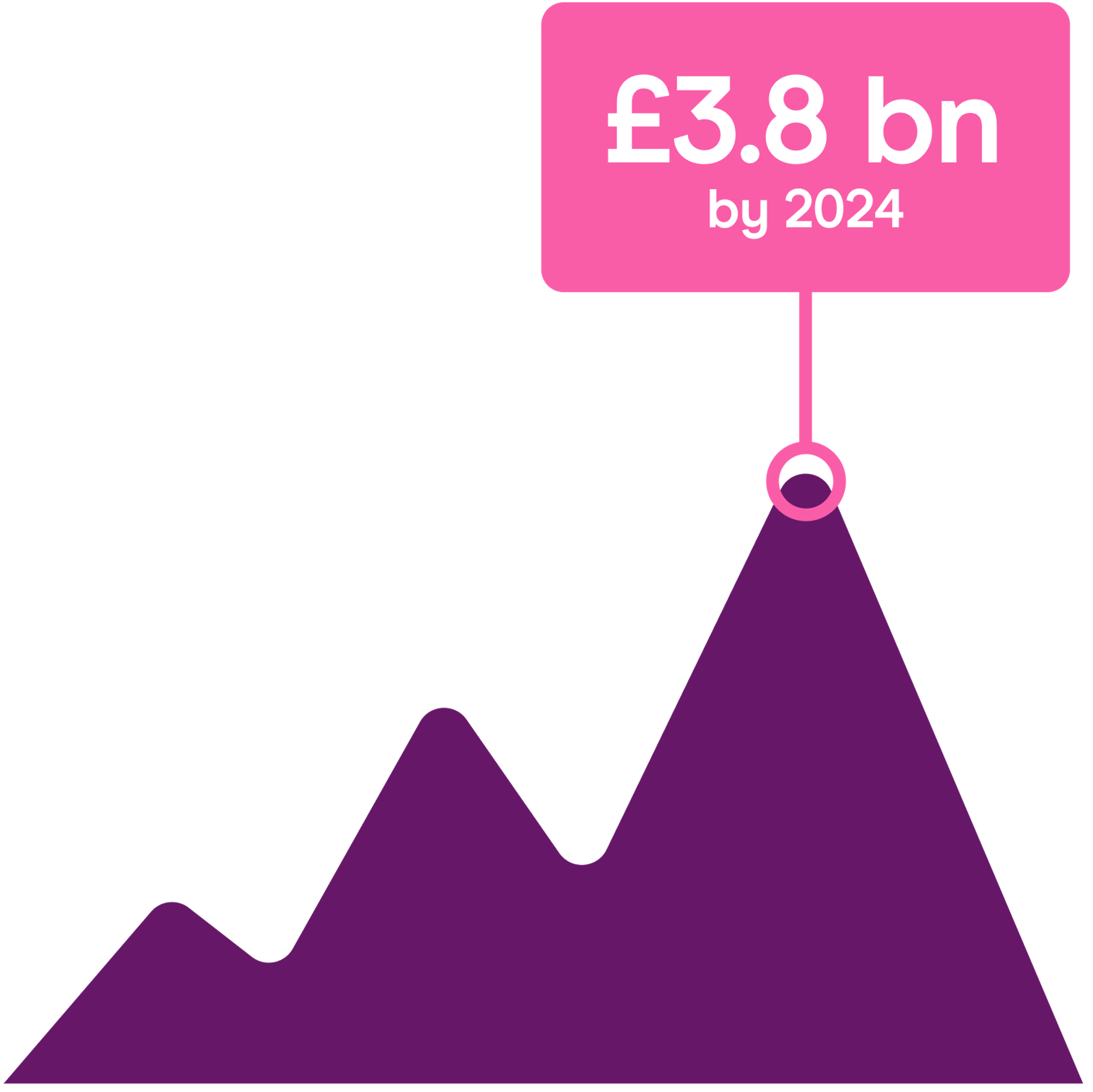

- The UK food delivery market will reach £3.8 billion by 2024 and £63.75 billion by 2029.

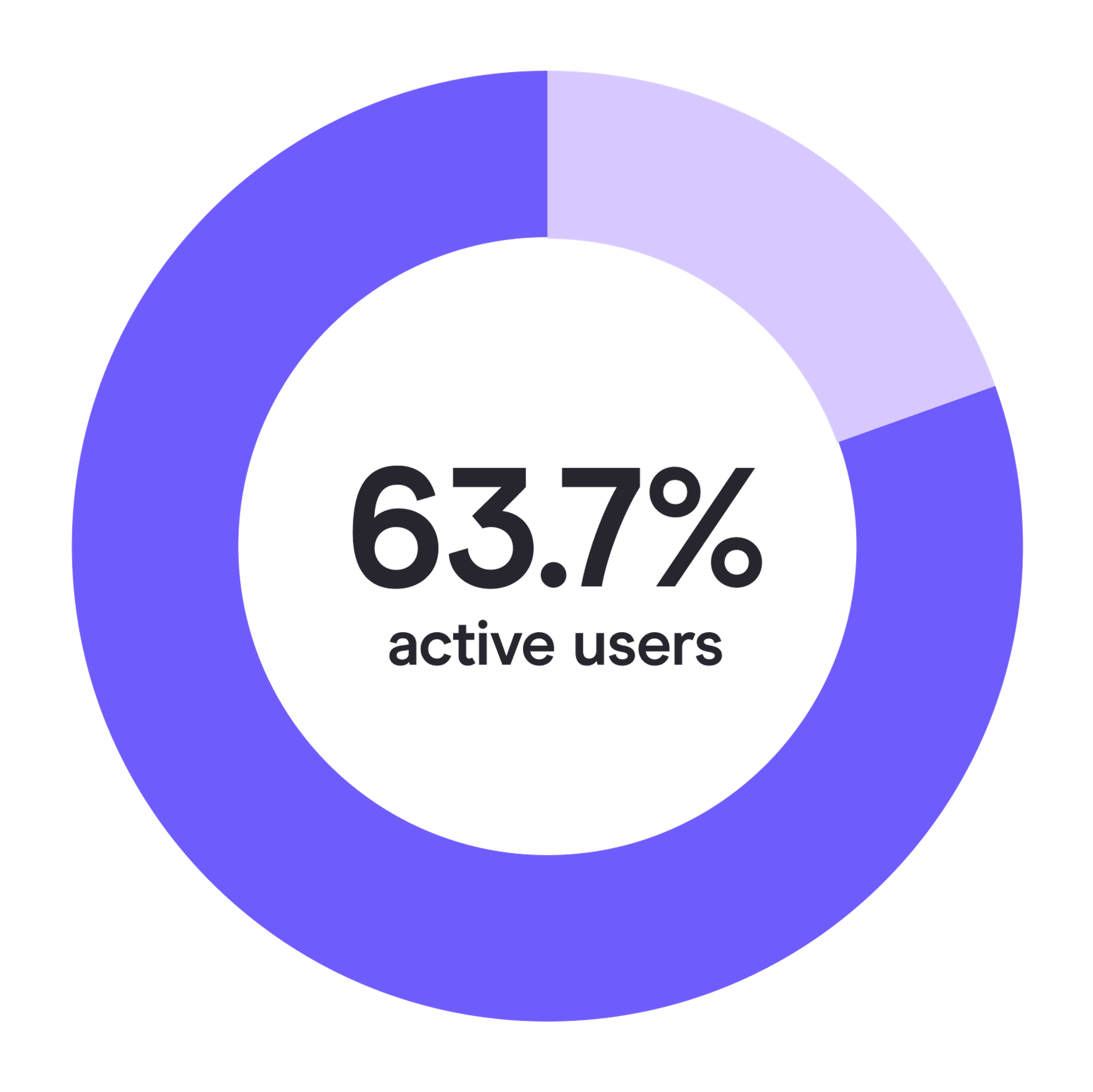

- 63.7% of the meal delivery market will be active users by 2024.

- Gen Z drives food delivery usage, with an average of 4.5 orders per month.

- Just Eat, Deliveroo, and Uber Eats dominate the market, with 45%, 27%, and 27% market shares, respectively.

- 35% more is spent on direct orders from restaurants than through third-party platforms.

- Key growth trends include advancements in AI, drone deliveries, sustainability, and healthier meal options.

Sources

2. Business of Apps - Food Delivery App Revenue

3. IBISWorld - Food Delivery App Market

4. MenuTiger - UK Food Delivery Spending

5. AHDB - Gen Z Food Delivery Usage

6. Ecommerce News UK - Millennial Spending on Food Delivery

7. Statista - UK Food Delivery Platforms

8. KPMG - UK Food Delivery Trends

9. McKinsey - Direct Restaurant Orders

10. Zion & Zion - Popular Food Ordering Times

11. Business of Apps - Holiday Food Delivery Trends

13. Tutor2u - Smartphone Penetration in Food Delivery

14. Eastern Peak - AI in Food Delivery

15. National Couriers Direct - Drone Delivery in the UK

16. Lumina Intelligence - Remote Working and Food Delivery

17. Mintel - Sustainable Food Delivery Options

18. Food.gov - Direct Ordering Trends

19. IBISWorld - UK Food Delivery Projections

20. Statista - Meal Delivery User Projections

21. Owner.com - Smart Home Integration in Food Delivery

View More UK Driving & Insurance Statistics

If you’re looking for deeper insights into UK driving behaviour, insurance trends and road safety, explore our full library of data-led statistics pages. Each guide includes detailed figures, expert commentary and actionable takeaways for drivers, tradespeople and delivery workers.

UK Driving Offence Statistics

Explore the latest driving offence statistics UK, including speeding, mobile phone offences, penalty points, age comparisons and regional hotspots.

Food Delivery Statistics

Dive into comprehensive UK food delivery statistics covering rider demographics, risk patterns, earnings and the growth of the UK delivery sector.

UK Van Driver Statistics

Learn more about the nation’s tradespeople through our detailed UK van driver statistics, including incident rates, mileage patterns and regional breakdowns.

Car Theft Statistics

Understand current UK trends, risk factors and the most-targeted models in our full UK Car theft stats guide.

Young Driver Statistics

Get insights into telematics behaviour, pass rates, claims data and insurance trends in our latest UK young driver statistics report.

Gender Car Insurance Statistics

Discover how premiums vary across age groups and regions in our detailed gender car insurance statistics UK breakdown.

Learn More About Zego’s Products and Services

Zego provides insurance designed for modern drivers — from private hire professionals to tradespeople, couriers, young drivers and those using cutting-edge vehicle technology. Explore our range of products below to learn more.

Private Hire Insurance

Cover built specifically for professional drivers using platforms like Uber, Bolt and local operators.

Learn more about private hire insurance.

Telematics Insurance

Get personalised pricing based on how you drive, powered by the Zego Sense app.

Discover our telematics insurance.

Courier Van Insurance

Insurance designed for van-based couriers carrying parcels or goods, perfect for Amazon and logistics work.

Explore courier van insurance.

Business Van Insurance

Annual, fully comprehensive cover for tradespeople and small businesses using vans for their own tools, materials and equipment.

Find out more about business van insurance.

Autonomous Vehicle Insights

Explore insurance implications, risks and opportunities as autonomous technology evolves.

Read more in our guide to autonomous vehicles.