Gender & Car Insurance Statistics in the UK

2026

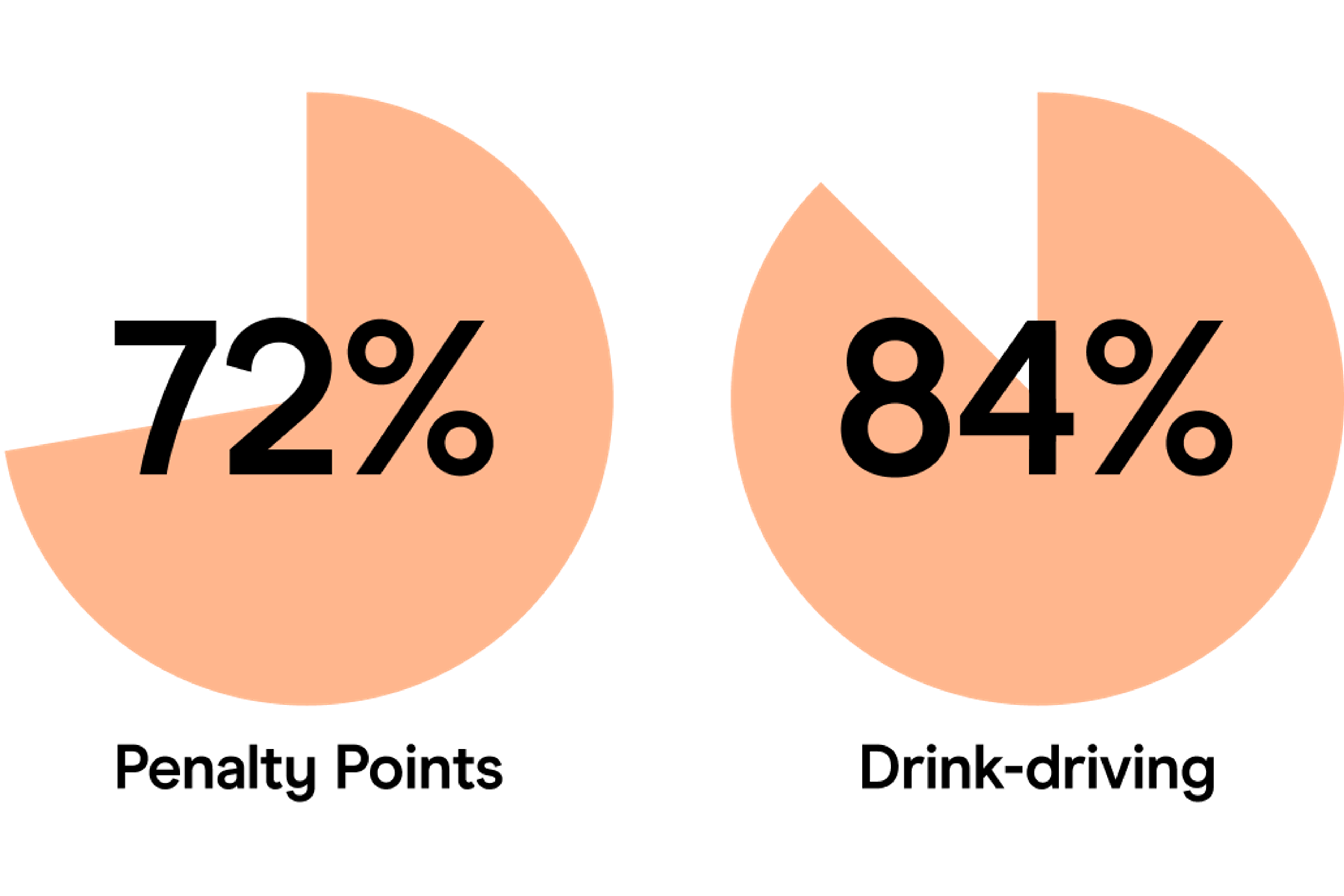

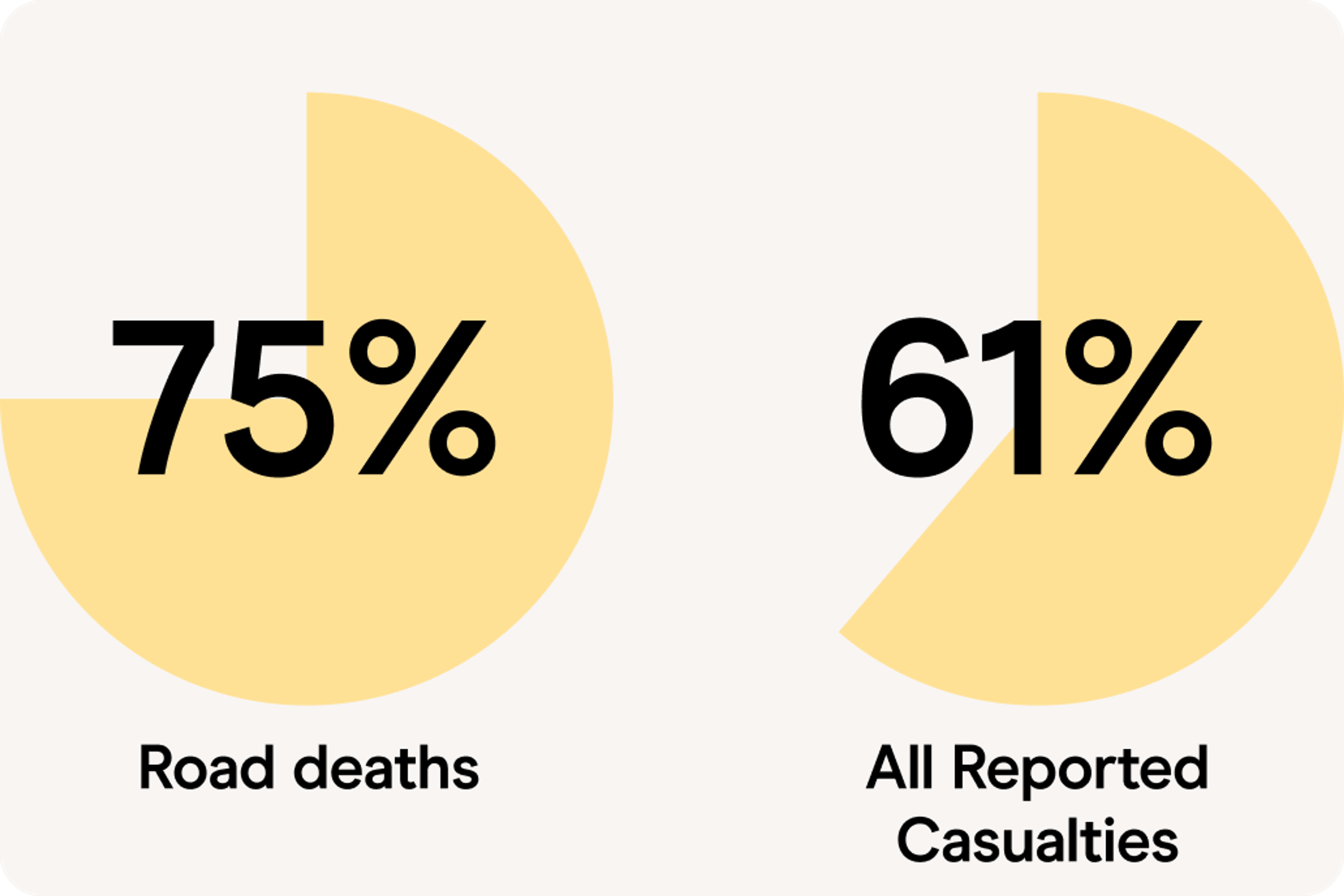

Men are still charged more, and in some cases hundreds of pounds more each year. The reason isn’t discrimination , it’s risk. Men are statistically more likely to take risks, be involved in accidents, make costlier claims, and drive higher-powered vehicles. Insurers may not be using gender directly anymore, but all the behaviours that correlate with it still add up.

Average premiums: Men vs Women (Who pays more?)

Another report puts the figures at £791 for men and £642 for women, leaving a difference of £149 [2].

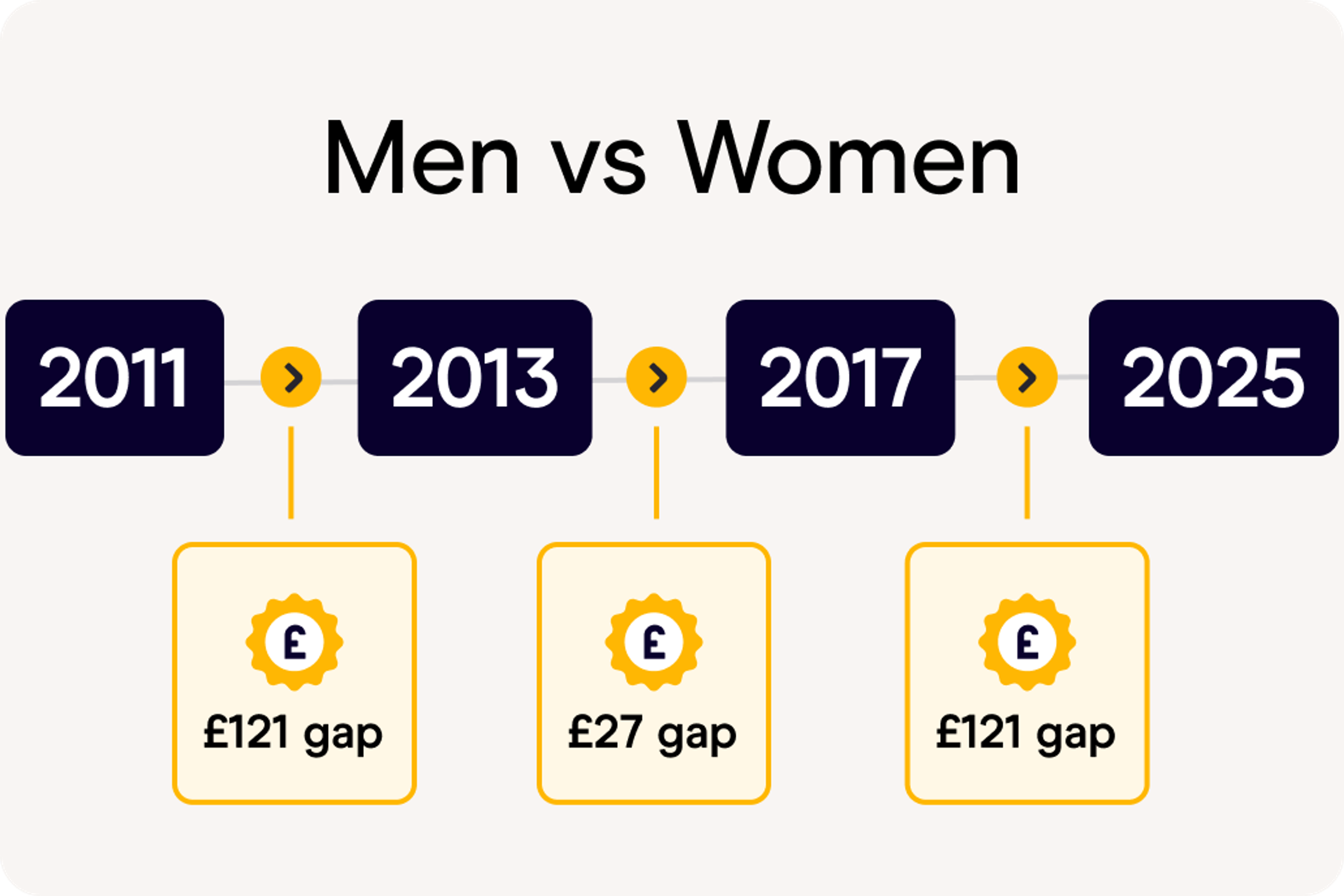

The gender gap has shifted over time. Before the EU directive, the gap was £121 in December 2011. It dropped to just £27 in 2013, but by 2017 it had widened back up to £121 [11].

Why men pay more

Claims: Who crashes more?

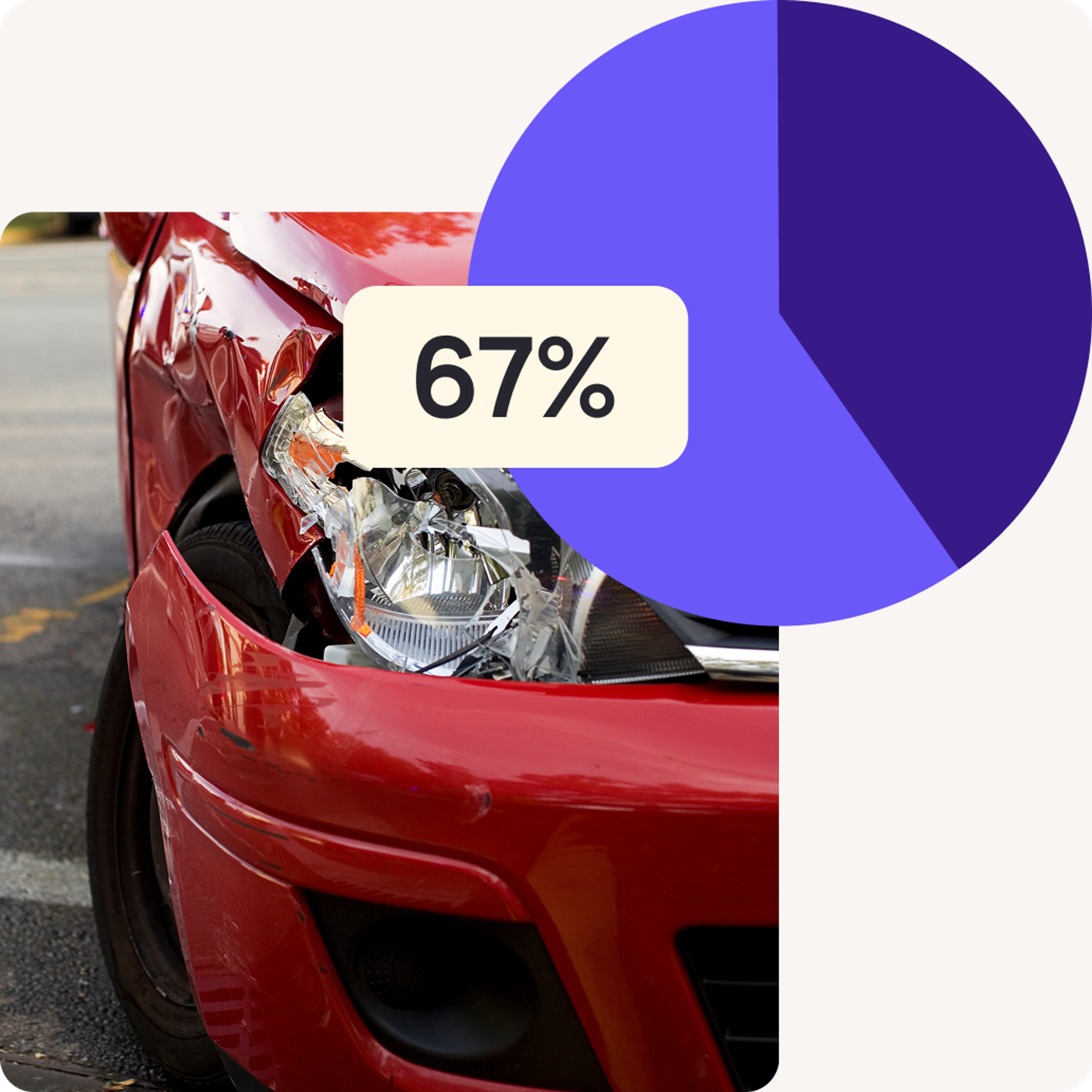

Confused.com data backs this up: in 2018, of 1.4 million insurance claims, 67% came from men and just 33% from women [11]. Men’s claims also cost more, averaging £5,577 compared to £5,150 for women [11].

Young drivers: The harshest gap

This gap mirrors young men’s overrepresentation in high-risk claims and accident data. For a deeper breakdown, see our young driver insurance statistics report.

Accidents and casualties

For insurers, that means higher expected payouts, which directly influences premiums.

Occupations and car choice

For more on vehicle risks, see our car theft statistics.

PassMeFast data showed that 16% of male drivers worked in the top 100 highest-premium occupations, compared to just 1% of women [11]. Drivers in those jobs faced average premiums of £895, versus £508 for others.

PassMeFast data showed that 16% of male drivers worked in the top 100 highest-premium occupations, compared to just 1% of women [11]. Drivers in those jobs faced average premiums of £895, versus £508 for others. Car choice matters too. 3% of men drive cars from the top 100 most expensive models to insure, compared with 1% of women. And when it comes to high-risk insurance groups (bands 31–50), 18% of men’s cars fell in that range, compared with 7% of women’s [11].

Car choice matters too. 3% of men drive cars from the top 100 most expensive models to insure, compared with 1% of women. And when it comes to high-risk insurance groups (bands 31–50), 18% of men’s cars fell in that range, compared with 7% of women’s [11].

Premium trends in the UK

But claims costs are still rising. In 2024, insurers paid out a record £11.7 billion, with the average claim climbing to £4,900, up 13% on the previous year [7].

Final thoughts

Until those underlying behaviours change, the gender gap in car insurance isn’t going anywhere.

Sources

- [1] https://www.howdeninsurance.co.uk/personal/motor/car-insurance/guides/car-insurance-for-women/

- [2] https://www.confused.com/compare-car-insurance/guides/has-car-insurance-gone-up

- [3] https://www.moneyexpert.com/car-insurance/ask-an-expert/do-women-still-get-cheaper-insurance-than-men/

- [4] https://www.oxera.com/wp-content/uploads/2018/03/The-use-of-gender-in-insurance-pricing-3.pdf

- [5] https://www.uswitch.com/car-insurance/car-insurance-for-young-drivers/young-drivers-insurance-statistics/

- [6] https://www.gov.uk/government/statistics/reported-road-casualties-great-britain-annual-report-2023/reported-road-casualties-great-britain-annual-report-2023

- [7] https://www.abi.org.uk/news/news-articles/2025/2/motor-claims-hit-record-11.7-billion-in-2024/

- [11] https://www.passmefast.co.uk/resources/driving-advice-and-safety/car-insurance/gender-gap-car-insurance

View More UK Driving & Insurance Statistics

If you’re looking for deeper insights into UK driving behaviour, insurance trends and road safety, explore our full library of data-led statistics pages. Each guide includes detailed figures, expert commentary and actionable takeaways for drivers, tradespeople and delivery workers.

UK Driving Offence Statistics

Explore the latest UK driving offence statistics, including speeding, mobile phone offences, penalty points, age comparisons and regional hotspots.

Food Delivery Statistics

Dive into comprehensive food delivery statistics covering rider demographics, risk patterns, earnings and the growth of the UK delivery sector.

UK Van Driver Statistics

Learn more about the nation’s tradespeople through our detailed UK van driver statistics, including incident rates, mileage patterns and regional breakdowns.

Car Theft Statistics

Understand current UK trends, risk factors and the most-targeted models in our full car theft statistics guide.

Young Driver Statistics

Get insights into telematics behaviour, pass rates, claims data and insurance trends in our latest young driver statistics report.

Gender Car Insurance Statistics

Discover how premiums vary across age groups and regions in our detailed gender car insurance statistics breakdown.

Learn More About Zego’s Products and Services

Zego provides insurance designed for modern drivers — from private hire professionals to tradespeople, couriers, young drivers and those using cutting-edge vehicle technology. Explore our range of products below to learn more.

Private Hire Insurance

Cover built specifically for professional drivers using platforms like Uber, Bolt and local operators.

Learn more about private hire insurance.

Telematics Insurance

Get personalised pricing based on how you drive, powered by the Zego Sense app.

Discover our telematics insurance.

Courier Van Insurance

Insurance designed for van-based couriers carrying parcels or goods, perfect for Amazon and logistics work.

Explore courier van insurance.

Business Van Insurance

Annual, fully comprehensive cover for tradespeople and small businesses using vans for their own tools, materials and equipment.

Find out more about business van insurance.

Autonomous Vehicle Insights

Explore insurance implications, risks and opportunities as autonomous technology evolves.

Read more in our guide to autonomous vehicle insurance.